|

http://www.patrickmckenna.com/blog

Page << Prev 40 41 42 43 44 45 46 47 48 49 Next >> of 95

Post #500 – Tuesday, October 26, 2010

How Firms Are Developing and Choosing Leaders

Last week I was in Washington DC attending the 2010 Futures Conference & Symposium hosted by the College of Law Practice Management and the American University Washington College of Law. What follows is excerpted from a blog post (courtesy of my friend Ron Friedmann) covering the session Developing and Choosing Leaders for the Next Generation and Beyond Panel Discussion. The moderator was Harry Trueheart, Chairman Nixon Peabody LLP. Panelists included Roland Smith, Center for Creative Leadership and Bill Migneron, COO of Lathrop & Gage LLP.

McKenna on How Law Firms are Developing and Choosing New Leaders:

- McKenna wrote “First 100 Days” for new managing partners a few years ago. That led to a program for new MP at University of Chicago. Reporting on a just-completed survey of 92 firms of over 100 lawyers . . . Sees a lot of ‘wishful thinking’ and ‘romantic folklore’ when it comes to law firm leadership. There is a myth of law firm leader as symphony conductor. The better analogy is that the leader is the main puppet in a show with 100s of partners tugging at the strings.

- New MP are surprised by the number of interruptions they have to deal with. Working with new MP, McKenna sees the challenges and cycles that MP experience. After 10 months, 40% question whether they want to stick with the role. 72% of MP today operate without a job description.

- Thinks job description is much more than HR issue. Did a description for one MP and came up with 72 bullet points.

- Only 25% of MP receive formal performance review - and that is way up from earlier.

- We imagine MP as a visionary leader ("Moses image"). In practice, has never seen a law firm leader who has articulated a vision that the partners adopt and embrace.

- McKenna asks how much time they spend on problem solving versus exploring opportunities. Former is 80%, latter is 20%. Of the 20% on opportunities, the split between immediate opportunities versus long term, 2/3 is on the present. So only 6% of management time is spent on future. But only 9% of MP, even in firms of over 500 lawyers, are full-time managers. Many still bill time.

- We like to think of MP as grooming future leaders. But only 14% have worked on a formal succession plan. Where there is a succession plan, the successor is usually of the same generation as the current leader.

It’s always nice to look back and see what I said. Thanks Ron. More information on this subject to follow.

Post #499 – Tuesday, October 19 2010

An Update On The Revolution

I just received a note from my old friend, Richard Susskind, letting me know that the paperback edition of his latest tome, The End of Lawyers? has now been released. As the first to review this book on Amazon last January, Richard kindly sent me a peek at some of the new material that he wrote for this revised edition: I just received a note from my old friend, Richard Susskind, letting me know that the paperback edition of his latest tome, The End of Lawyers? has now been released. As the first to review this book on Amazon last January, Richard kindly sent me a peek at some of the new material that he wrote for this revised edition:

When first published, in 2008, this book understandably caused unrest amongst lawyers. I spoke of the increasing commoditization of legal services, of a need to decompose legal work into tasks and source each in the most efficient way, of a related increase in the outsourcing, off-shoring and the multi-sourcing of legal work, of externally funded legal businesses, and of an increase in the impact of disruptive technologies. I said that the market for the traditional legal practitioner would diminish, as would the need for traditionally trained law graduates. I ventured also that many small firms and sole practitioners would struggle to survive, numerous medium-sized firms would merge, some large firms would shrink, and others would fold.

I stand by all of these projections.

More specifically, I made three main predictions that can now be tested. The first was that clients (businesses and individuals) would increasingly demand ‘more for less’ – more legal service at less cost. After September 2008, this unarguably became the case. In dreadful economic conditions, in-house lawyers were required to slash their legal budgets, and law firms, in turn, proposed reduced rates, new charging models, and more efficient ways of working. Looking ahead, boards and shareholders will surely challenge in-house lawyers who countenance any return to pre-recession pricing practices.

My second prediction was that fundamentally new ways of sourcing legal work would emerge. Since then, perhaps the most active area of development in the entire legal services market has indeed been in legal process outsourcing (LPO). This involves passing routine legal work - including document review in litigation and due diligence – to independent providers in low cost locations. Given the rise of activity since, it is remarkable there were no major LPO success stories for me to write about two years ago. Today, however, the rapidly growing LPO sector in India is already worth half a billion dollars, and is helping clients such as Rio Tinto, BAT, Microsoft, and BT.

Third, I anticipated widespread uptake amongst lawyers of social networking systems, such as Facebook. This has not yet come about, but I expect it will. Twitter is an interesting case study. Almost unknown in the legal profession in 2008, it now has over 100 million users worldwide. Many lawyers dismiss it as a plaything for kids, as irrelevant for the serious legal practitioner. However, there are now senior in-house lawyers who use Twitter, sending out messages about what they are doing and thinking. If clients are sending out regular updates on their news and views, lawyers should be on the receiving end (even if the medium has a slightly silly name).

What of the future? I believe the next few years will bring further and massive change:

LPO will burgeon, paralegals will be employed more extensively, clients will share the costs of some legal services, document and workflow automation will be widely deployed, social networking will take hold, and high definition, desktop-to-desktop video conferencing will transform communication between lawyers and clients.

Great reductions in public legal funding will compel lawyers to rethink the ways they work and urge professional bodies to think more profoundly about the future (the American Bar Association is leading the way with its Commission on Ethics 20/20). And governments will become increasingly committed to virtual courts and online legal guidance.

Major accountancy firms will renew their interest in the legal sector, largely by offering multi-disciplinary services to the mid-market, as well as LPO. Leading legal publishers will expand their dominance over online legal service. And private equity firms will make their long-awaited investments, mainly by helping to build hi-tech, process-driven legal businesses that can deliver high volume legal work at lower prices than conventional law firms.

There is no finish line in the modernization of legal services.

Post #498 – Monday, October 18, 2010

Shaping Our World Between Now and 2050

In celebration of the publication of Future Shock, Toffler Associates hosted a conference last week in Washington DC. This invitation-only event was held in commemoration of the 40th anniversary of Alvin Toffler’s groundbreaking work that forecast many of the trends we are living amidst today. Attendees at last week’s event were invited to look ahead to the next 40 years and examine the forces that will shape the future. Here is a sampling of some of the drivers of change that were identified that will likely shape our future.

• When it comes to work, “where” will matter less and less. • When it comes to work, “where” will matter less and less.

- The proliferation of high speed internet connections, the growth of low-cost videoconference technology, and the ability to rapidly and easily move around the globe via interrelated networks of airlines will allow professionals to complete their work anywhere in the world.

- The major challenge this will create is for local and national governments to play catch-up with regard to modernizing tax law.

• Work will continue to expand to fill whatever time and space is available.

- Work will continue to be driven by knowledge. The increased knowledge content of work means that communication and the speed of knowledge transfer will be increasingly critical to the success of business.

• Knowledge will be a major source of capital.

- The ability to exploit information across traditional boundaries will be a great boon to developing countries as they come to recognize the importance of knowledge capital.

- Recognizing the importance of knowledge capital, developing countries will begin to place priority emphasis on education and knowledge transfer.

- The US will make international education a top priority, encouraging Americans to travel to other countries and see themselves as part of the global community.

• High costs of “obsoledge” will impact global competitiveness.

- Every chunk of knowledge has a limited shelf life, becoming, at some point, obsolete – “obsoledge.”

- Accelerating change speeds up the rate at which knowledge becomes obsoledge. Every passing semi-second, accuracy of our knowledge about our investments, our markets, our competition, our technology and our clients will diminish.

- Obsoledge costs will be in the form of degraded decision-making.

• Mobility in the global market will become a priority.

- Safe, efficient transportation will be crucial to the global economy as it lies at the core of international trade. Future economic activity will drive unprecedented demand for global transportation services.

• China will continue to position itself as a long-term economic power-player around the globe.

- China teams with other emerging countries (Brazil, India and China) to influence currency utilization.

- China partners with other countries (Venezuela and Africa) to meet energy needs and to import a wide range of raw materials.

Post # 497 – Monday, October 18, 2010

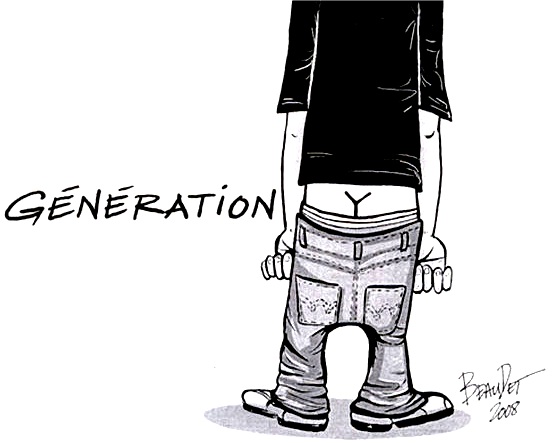

Generational Understandings

If I understand this generational thing correctly . . .

The Silent Generation are people born before 1946.

The Baby Boomers are people born between 1946 and 1959.

Generation X are people born between 1960 and 1979. Generation X are people born between 1960 and 1979.

Then Generation Y are people born between 1980 and 1995.

So, why do we call the last one Generation Y?

I had never known . . . but then came across a cartoonist who explains it quite eloquently.

I learned something new today!

Post #496 – Wednesday, October 13, 2010

Globalization 2.0

Are law firms prepared for the next wave of globalization? The developments in emerging markets is old news. Tom Friedman discovered that the world was flat back in 2005. But even as much of the developed world is struggling with weak consumer demand and stubbornly high levels of unemployment, the emerging-market countries are writing a new chapter in the story of the global economy. Today, it's about China and India and Brazil. But, there is also another wave of similarly sweeping changes and growth in other parts of the world. For example, take a look at Vietnam. It is a market of 86 million people - more than half under 25 years of age. Are law firms prepared for the next wave of globalization? The developments in emerging markets is old news. Tom Friedman discovered that the world was flat back in 2005. But even as much of the developed world is struggling with weak consumer demand and stubbornly high levels of unemployment, the emerging-market countries are writing a new chapter in the story of the global economy. Today, it's about China and India and Brazil. But, there is also another wave of similarly sweeping changes and growth in other parts of the world. For example, take a look at Vietnam. It is a market of 86 million people - more than half under 25 years of age.

In the book, Vietnam: Rising Dragon, BBC correspondent Bill Hayton explains: "Vietnam is in the middle of a revolution. Capitalism is flooding into a nominally communist society, fields are disappearing under new industrial parks, villagers are flocking to booming cities . . . It's one of the most breathtaking periods of social change anywhere, ever."

The money is pouring in. The factories are going up. Samsung has a $700 million plant in Hanoi. Intel has a billion-dollar chip plant outside of Saigon. Canon, Hon Hai, NEC and many others are already there. Yet ports are congested and roads are poor. It reminds one of the early years of Japan or South Korea . . . or China.

If you listen to what companies are saying - especially some of the big multinationals or some of the small players with operations overseas - these kinds of markets get them excited. They think about all the razor blades and beer they can sell. They will have hundreds of millions of people that can buy simple things.

Take Proctor & Gamble, a huge consumer products company. It estimates that if people in China and India spent at a level comparable to that in Mexico, P&G's sales would grow by $40 billion. That's huge for a company that generates $79 billion in sales today. That potential $40 billion prize has sharpened the attention of P&G's top brass. And it's a lure for competitors as well. What will drive these sales is the bulging global middle class. That middle class gets more than 70 million new members a year - on its way to 2 billion in two decades.

Meanwhile, there are now approximately 35 American law firms in Tokyo, 34 in Hong Kong, 23 in Shanghai and 23 in Beijing – but only 6 U.S. law firms in Vietnam. Watch and see what happens next.

Post #495 – Friday, October 1, 2010

The Fall 2010 Issue of International Review Is Now Available

The latest issue of my International Review 24- page magazine is hitting the desks of law firm managing partners everywhere. Once again this issue contains a number of pragmatic articles on law firm management and strategy:

• Evaluating Your Performance As A Managing Partner - by Patrick J. McKenna • Evaluating Your Performance As A Managing Partner - by Patrick J. McKenna

Working with your colleagues, early in your tenure, to formulate an evaluation process is a great opportunity for you to manage everyone’s expectations.

• The Managing Partner's Speech - by David H. Maister

In the event your managing partner is in need of a speech, here’s one written for the leader of a large, national professional firm who asked what he should say upon his election to the role.

• Building An Environment of Trust - by Managing Partner LAB

How do you ferret out the truth when well meaning partners edit themselves, staff are not naturally inclined to disagree with you, and the information you receive is, so often, being filtered?

• Rules of Engagement - by Patrick J. McKenna

Rules of engagement are working guidelines which a group consciously establishes to help individual members determine how they will communicate, participate, cooperate and support each other.

• Uniting A Divided Firm - by Managing Partner LAB

How do you overcome a strong sense of "us and them" amongst your firm’s various offices?

• Law Firm Leadership Reflections: Practical Advice For Those Who Manage - by Patrick J. McKenna

Excerpted from my blog, here are a selection of short snippets for reflecting on everything from what is on the minds of senior general counsel to what experiences best develop new leaders.

• The Leader's Role in Integrating Laterals - by Managing Partner LAB

As a new leader, what specific actions would you recommend i take responsibility for, in helping orientate and integrate new lawyers?

I am pleased to have been putting out this magazine for some years now. It essentially started when I first began mailing copies of periodic articles I had authored to select managing partners back in the Fall of 1998. Today, I am (to the best of my knowledge) the only law firm consultant to publish his own magazine for firm leaders.

If for some reason, you haven’t received your Fall International Review magazine, either click on the cover above to download a PDF copy or kindly shoot me a note and I will be pleased to get a hard copy sent off in the mail to you.

Post #494 – Friday, October 1, 2010

The Top Global Elite

Which law firms are winning the battle for mind and global market share in 2010? Which law firms are winning the battle for mind and global market share in 2010?

My friend, Juliana Garcia, New York-based Director of Strategy at international research firm Acritas, unveiled their first-ever sharplegal Global Elite Brand Index – a ranking of the top global brands of the legal industry, as recognized by General Counsel from the world's top companies.

According to Juliana, these are the top corporate brands major companies turn to for legal advice on high-stakes, high-value, cross-border matters:

Acritas published these rankings based on a global survey of 1,000 executives about law firms they employ most often for cross-border litigation and deals. This index is determined through the answers to four open-ended questions regarding:

- Top of mind awareness

- Favorability

- Most considered for multi-jurisdictional deals

- Most considered for multi-jurisdictional litigation

According to Acritas research, the "Top 15 Global law firm brands achieve 50% higher revenue growth since 2007 than their global 100 peers" and the "Top 6 Global law firm brands achieve almost double the revenue growth since 2007 of their global 100 peers"

Post #493 - Thursday, September 23, 2010

Advice For Those In Support Positions

I happened to have had lunch with a new marketing professional recently. I spent some time briefing her on the strategic project that I was doing with her firm. During our discussions she asked if I might have any advice for her, given that I’ve spent three decades working with law firms and this was her first foray into professional services.

Now, I’ve heard from a number of business development professionals about how they spend far too much of their time having to justify their existence at their firm; how no one knows or appreciates the contribution that they are making, how their reporting structure has become overly bureaucratic, how they are continually having to defend their budgets, and so forth. Some long-term folks are even questioning whether this is still the right career choice for them, feeling that they suffer from the “what-have-you-done-for-me-lately” syndrome far more than any of their other department head counterparts.

I told this particular business development professional that there are a couple of specific actions she might want to think about taking in her new position . . . I told this particular business development professional that there are a couple of specific actions she might want to think about taking in her new position . . .

One, if you think about law firms, irrespective of size, you can place all the partners across a bell curve. 10% originate the work, 80% do the work, and with the remaining 10% you feed the work through the top of the door, pull it out the bottom, but never expose them to clients. My advice is that you make it a regular habit to visit, one-on-one with all of the equity partners twice a year, and ask of each, what activities they think you should engage in to both support their efforts and to add value. In visiting with these partners, recognize that the top 10% represent the power in the firm and you must ensure that you get them in your camp and understand their views and needs. The middle 80% probably won’t give you any answers of much substance, but just asking the question will ingratiate you to them. And the bottom 10% if you are not careful will find never-ending ways to suck the life-blood out of you (“energy vampires”) by consuming your time in meaningless adventures. Any real time invested in them is to be avoided at all costs.

Two, in most professional service firms, money is the currency of respect. Why not consider adopting a reasonable charge-out rate for the services you provide. Institute a “mock” charge-back system, placing a dollar value on the marketing department’s services and issuing an account at the end of each month for the value of the services provided to different practice groups and the firm in general. Do it as if you were an outside marketing consultancy providing these same services. This initiative could well progress into your group developing it’s own engagement process, seeking interesting problems to solve and making “pitches’ to your internal clients.

Three, that said, the bottom line is that you do need to recognize that you are a support center and not necessarily a revenue center. And as a support you must always be sensitive to justifying you and your department’s existence as power partners may very well ask what it is that you are accomplishing. My advice is, at the very least, to begin preparing a written, one-page, Friday afternoon wrap-up, in bullet point form, of your core activities and accomplishments for that week and e-mail it to the managing partner and whomever else you think important enough to receive your report. Keep your Friday briefings in a binder and prepare a monthly summation. Keep those monthly reports together and prepare a quarterly synopsis. Keep your quarterly highlights so that you can produce an Annual Report. Never let any partner ask what it is that you are doing or contributing without having others informed enough to quickly provide ample written evidence.

The above represents my latest column for Slaw. Slaw identifies itself as “a cooperative weblog on all things legal.” Slaw has been publishing for five years and gets 30,000 unique visitors and about 100,000 visits every month. For the past two consecutive years it has been the winner of three different awards as the best legal blog. I’m honored to have been asked to become a regular columnist and invite you to comment on my latest meandering.

Post #492 – Tuesday, September 14, 2010

Handling Partners With Strong Views

Two years ago, together with Baker & Daniels Chair Emeritus Brian K. Burke, I co-founded what is now known as The LAB (the Managing Partner Leadership Advisory Board) – a forum designed to provide recently appointed managing partners with a source for obtaining pragmatic advice on their leadership questions and critical burning issues. The formation of this group was the result of suggestions made during our bi-annual First 100 Days master class for new managing partners and has proven to be a valuable resource for new leaders. Two years ago, together with Baker & Daniels Chair Emeritus Brian K. Burke, I co-founded what is now known as The LAB (the Managing Partner Leadership Advisory Board) – a forum designed to provide recently appointed managing partners with a source for obtaining pragmatic advice on their leadership questions and critical burning issues. The formation of this group was the result of suggestions made during our bi-annual First 100 Days master class for new managing partners and has proven to be a valuable resource for new leaders.

Here is the latest question in a series of some twenty different queries that The LAB members have now responded to:

Since recently becoming our firm’s managing director, I’ve been engaging a number of my colleagues in discussions on how we should be concerned with delivering more value to our clients. I think this is an important issue for us going forward and find that most of my partners are on-board conceptually and willing to explore the issue. However, there are a few who are have responded uncompromisingly, with rather curt, dismissive statements whenever the topic comes up. Any tips for me on how you might handle the partner who holds strong beliefs on high-stake topics and demonstrates little willingness to either listen or consider alternative views?

Read: Handling Partners With Strong Views

The LAB responses derive from its members' many years' experience as law firm leaders. Along with Brian and I, the LAB is comprised of the following distinguished current and former law firm leaders: Angelo Arcadipane (Dickstein Shapiro LLP); John Bouma (Snell & Wilmer LLP); Ben F. Johnson, III (Alston & Bird LLP); Keith B. Simmons (Bass Berry & Sims PLC); William J. Strickland (McGuire Woods LLP); Harry P. Trueheart, III (Nixon Peabody LLP); R. Thomas Stanton (Squire Sanders); and Robert M. Granatstein (Blake Cassels and Graydon).

Post #491 – Thursday, September 9, 2010

Little Demand in Australia

My post of last Wednesday (#490) claiming that the demand side of the market was not demanding generated a number of responses on Legal OnRamp from both lawyers and general counsel, all of which concurred with my central message that change was slow in coming from the client side. Well, now here's some further confirming research from the other side of the globe . . .

In a comprehensive study by the Corporate Lawyers Association of New Zealand (CLANZ) and the Australian Lawyers Association (ACLA), the ACLA/CLANZ Legal Department Benchmarking Report 2010 delivers the results of the most extensive study of its kind ever conducted. My good friend and former CLANZ president Ron Pol, and his professional services company Team Factors conducted the research with some of the largest corporate and government users of legal services in Australia and New Zealand, with an average legal spend of $5.5 million in New Zealand and $13.5 million in Australia. In a comprehensive study by the Corporate Lawyers Association of New Zealand (CLANZ) and the Australian Lawyers Association (ACLA), the ACLA/CLANZ Legal Department Benchmarking Report 2010 delivers the results of the most extensive study of its kind ever conducted. My good friend and former CLANZ president Ron Pol, and his professional services company Team Factors conducted the research with some of the largest corporate and government users of legal services in Australia and New Zealand, with an average legal spend of $5.5 million in New Zealand and $13.5 million in Australia.

Here are but a few of Ron’s findings:

Selecting good outside lawyers was not regarded as a pressing issue facing any legal department, but the need to reduce outside legal costs featured consistently as a top priority.

The actual extent of alternative fee arrangements is less than some reports suggest. Notwithstanding continued antipathy towards hourly billing and reports of a surge in alternative fee arrangements, the report confirmed hourly billing's continued dominance. On average, standard and discounted hourly rates still represent 85% of fee arrangements by value, in both New Zealand and Australia. Across the board, fixed fee arrangements represent around 13% of the balance. This means that, overall, the impact of most of the alternatives beyond fixed fees seems virtually negligible.

“It’s hardly surprising that costs are amongst clients’ top concerns”, says Ron, “but it’s not just the size of legal fees; the way that lawyers communicate costs – and the timely reporting of unexpected overruns – seems to be a big part of the issue.”

The general counsel of some of Australasia’s biggest organizations, with some of the largest teams of in-house lawyers and most sophisticated legal procurement systems, reported that when they asked law firms for fee estimates, the final cost was consistently on or below budget just 4% of the time.

Meanwhile Ron’s findings contain some unwelcome news for law firms. None of the respondents expect to significantly increase their use of big firms and as many as 30% expect to reduce their use of national full service firms over the next two years.

Page << Prev 40 41 42 43 44 45 46 47 48 49 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8