|

http://www.patrickmckenna.com/blog

Page << Prev 30 31 32 33 34 35 36 37 38 39 Next >> of 95

Post #581 – Thursday, December 1, 2011

On the Subject of Strategic Focus

This post has its origins in a particular incident that compelled me to share some further thoughts with the firm’s managing partner.

Dear Managing Partner:

In our strategic planning committee discussions of earlier this week, we heard from one senior partner about the importance of capitalizing on an opportunity to open a new office in another State. He informed us about this lawyer he knew who could bring us a $2 million book of business. I asked how that would augment or support the firm’s core area of industry strength. We learned that it had nothing to do with the firm’s area of strength. At the time, rather than get into a protracted debate, I abstained from commenting any further on this issue. Upon reflection, while that was still the proper action to take at the time, I should offer my thinking to you on this subject – as I believe it is critical to your firm’s strategy going forward . . .

To read the complete article - download the PDF.

The above represents my latest column for Slaw.ca Slaw identifies itself as “a cooperative weblog on all things legal.” Slaw has been publishing for five years and gets 30,000 unique visitors and about 100,000 visits every month. For the past two consecutive years it has been the winner of three different awards as the best legal blog. I’m honored to have been asked to become a regular columnist and invite you to comment on my latest meandering.

Post #580 – Thursday, December 1, 2011

The Great Eurozone Bailout Scam

Yesterday, the announcement was made that six central banks, led by the Federal Reserve, made it cheaper for BANKS to borrow dollars in emergencies in a global effort to ease Europe’s sovereign-debt crisis. The Fed coordinated their move with the European Central Bank and the central banks of Canada, Switzerland, Japan and the U.K. all to bolster financial markets by increasing the availability of dollars outside the United States. In effect, the Fed has promised to be the lender of last resort for the entire global economy.

But hold on here . . . where is the IMF, the World Bank and why is the US Fed involved in a Eurozone bailout, when they have yet to solve their own economic problems at home? Is this not just a US taxpayer bailout of Europe?

Regular readers know that I have a keen interest in economics bolstered by a number of learned friends who really know what they are talking about. One of my economist buddies, who sent an e-mail to me last night, thinks that he knows the answer to this curious turn of events . . . Total American exposure to the unfolding European debt crisis could be as much as $4 trillion. That is THREE times bigger than subprime!

As the head of one brokerage firm expressed it: "MF Global is almost certainly the mere tip of the iceberg. There is massive industry-wide exposure to European sovereign junk debt. These firms are suicidally leveraged and will likely stand massive, unmeetable collateral calls in the coming weeks as Europe inevitably collapses."

At its core, Greece should have defaulted a long time ago. The country has a mountain of debt, and no way to pay it back. So why do European leaders keep lending Greece money? Here's what my economist buddy thinks . . . Governments aren't trying to save Greece, they're saving banks dumb enough to have "invested" in Greece!

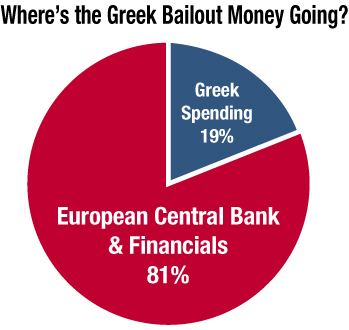

For proof, just take a look at where Greece's bailout money is going: For proof, just take a look at where Greece's bailout money is going:

As you can see, the Greek government keeps just 19% of all the bailout money that's supposedly for Greece, everything else goes to "financials" and the ECB (European Central Bank). But why is 81% of Greek bailout money going to "financials," when the country has massive debt and expenses to pay? Because the Greek bailout is quietly just ANOTHER bank bailout! This might all sound like a big conspiracy theory, but the evidence seems crystal clear. My economist friend thinks bureaucrats are keeping Greece afloat just long enough for their buddies in the banking industry to minimize their losses on sovereign debt. And, just look how banks are frantically taking advantage of this rapidly closing window of opportunity:

- France's biggest bank, BNP Paribas just sold European sovereign debt for an $812m LOSS!

- Germany's Commerzbank took a loss too as it cut exposure to Greek and other European bonds by 22%.

- And Barclays cut exposure to Greek and other European bonds by 31% in just three months.

The fact these big banks are willing to eat huge losses right now proves they are desperate to unload European government debt.

Greece needs TEN times more money than it's asking for to make its debt payments in January 2012. Greece is now so desperate for money, the yield on a one year government bond has soared to 300%! Thus, if you loan the Greek government $10,000, it must -- despite an ever growing mountain of debt -- pay you back $40,000 within a year. Of course this is a fantasy. The Greek government would never be able to pay you back. Greece is out of money and out of time.

BOTTOM-LINE: The "Bailout" is a SCAM. Most of the money is funneled back to the financial system, giving banks more time to reduce their sovereign debt exposure for the start of the new fiscal year in January 2012. If Greece does default on its debt, remember, with exposure three times bigger than subprime, the U.S. economy is NOT immune.

LATER THAT SAME DAY:

"World Financial System on Brink of Collapse" - - The world financial system is on the brink of collapse, with developed markets running full speed ahead toward disintegration, says billionaire financier George Soros. Although developing countries are battling a slew of problems themselves, such as corruption and tattered infrastructure, they will likely end up faring better than markets in the big, industrialized nations, Soros says. Developing countries are unscathed by the "deflationary debt trap that the developed world is falling into," Soros told a New York gathering at the International Senior Lawyers Project, a group that provides pro bono legal services.

Post #579 – Friday, November 25, 2011

Managing Partner Forum Survey Results

I participated as a faculty member in the Managing Partner Forum, held at The University Club of Chicago last week. One of the sessions in our day’s agenda involved having about fifty firm leaders discuss and vote upon (using anonymous electronic voting machines) 32 different management and operational issues facing their firms – everything from the firm’s financial performance and future expectations to plans for 2012. I participated as a faculty member in the Managing Partner Forum, held at The University Club of Chicago last week. One of the sessions in our day’s agenda involved having about fifty firm leaders discuss and vote upon (using anonymous electronic voting machines) 32 different management and operational issues facing their firms – everything from the firm’s financial performance and future expectations to plans for 2012.

Here are a few excerpts showing how the firm leaders from firms of over 80 attorneys in size are feeling about selective issues:

• Question: Looking ahead, what are your expectations for 2012?

- Only 12.5% expressed the feeling that 2012 would be a good year.

• Question: What are your firm’s plans regarding hourly rates in 2012?

0 % hold the line on hourly rates in 2012

37.5 % across the board increase of less than 3%

37.5 % across the board increase of more than 3%

25.0 % increase rates selectively on a client-by-client basis

0 % lower rates in response to client demands

• Question: Which specific areas do you plan to focus time and attention on in 2012 to improve your firm’s performance?

#1: Adopt a firm-wide strategic plan and invest in its implementation

#2: Develop and maintain highly functioning practice groups

#3: Ramp up marketing and business development

#4: Deal effectively with underperforming partners

#5: Instill a ‘firm-first’ culture and mindset among attorneys

Less important matters included issues like: enhancing internal communications, recruiting and retaining associates, identification and grooming of future leaders, more aggressive billing and collection practices, improving cross-selling, etc.

• Question: The managing partner’s authority is fully understood by the firm’s partners / shareholders?

Surprisingly 34% of the participants either disagreed or confessed that they were not sure.

• Question: What statement best characterizes how you candidly view your position?

The majority of the participants responded that: “The Managing Partner is primarily a consensus builder and needs to harness the partners to make and take the hard decisions.”

Post #578 – Friday, November 25, 2011

Peters On Excellence

I recently revisited an old friend only to discover that he too had revisited an old friend . . . in articulating his most recent thoughts on ‘excellence.’ Here are my favorite ten points from Tom Peters on “Excellence Now, Excellence Always”: I recently revisited an old friend only to discover that he too had revisited an old friend . . . in articulating his most recent thoughts on ‘excellence.’ Here are my favorite ten points from Tom Peters on “Excellence Now, Excellence Always”:

• People first, second, third, fourth … The “business” of leaders is people: to inspire / engage / provide a trajectory of opportunity—enterprise of every size and type as “cathedral” for human development.

• The Practice Group Manager’s sole raison d’etre: Make each of my team members more successful!

• Appreciation. Acknowledgement. “The deepest human need is the need to be appreciated.”— Believe it! A few kind words are often remembered for years!

• Weird / There are no “normals” in the history books! Ensure a healthy supply of oddballs. Diversity of every flavor = Fresh perspectives. Better decisions.

• Memories That Matter. And don’t. “People stuff” sticks with you: You’ll look back on the handful of people you developed who proceeded to change the world—and the multitude (if you’ve earned it) who say, “I grew most when I worked with you.”

Ever seen a tombstone engraved with the deceased’s net worth?

• “Brand you”—stand out for something valuable, or else; learn something new every day, or else! “Distinct or Extinct!”

• MBWA / Managing By Wandering Around. “In touch” is “not optional” You = Your calendar. Calendars never lie! • MBWA / Managing By Wandering Around. “In touch” is “not optional” You = Your calendar. Calendars never lie!

“What do you think?” “How can I help?” — MBWA & Eight words, repeated like a mantra while “wandering around,” that unlock engagement / success for multitudes.

• “Web-Social Media“ Everyone becomes our valued partner, a member of our community—and watchdog. SM can be lynchpin of transformative strategy—for firms of every shape and size.

• Innovation “secret” #1: “Most tries wins.” “A Bias for Action”—Excellence trait #1,

In Search of Excellence: “Ready. Fire! Aim.” Try a lot = Fail a lot. “Fail. Forward. Fast.” “Fail faster, succeed sooner”

• “Be the best. It’s the only market that’s not crowded.”

Post #577 – Wednesday, November 23, 2011

Future of Legal Services Webinar

Following on my announcement (Post #569) of a new report entitled The Future of Legal Services, the folks at Ark have now organized a special Webinar. This web-based discussion features three of the contributors to the report. I hope you’ll join us as we collectively look to the future—providing an opportunity for attendees to better understand (and challenge) assertions and assumptions about the changing legal services landscape.

JOIN US FOR A WEBINAR ON JANUARY 31 AT 1:00 P.M. (EST) JOIN US FOR A WEBINAR ON JANUARY 31 AT 1:00 P.M. (EST)

What does it mean to you—and what are you going to do about it? The legal profession faces a time of unsettling change. While many may prefer to ignore that change, we may not have the luxury nor the choice. Some lawyers and firms see the changing environment as an opportunity to adapt and reassess their working practices, so that they can take advantage of the opportunities ahead and prosper in this increasingly competitive marketplace. Our esteemed panel will focus on exactly what you should be doing to prepare for an uncertain future.

THE PANELISTS INCLUDE:

Patrick J. McKenna (www.patrickmckenna.com) has worked with the top management of premier law firms internationally to discuss, challenge and escalate their thinking on how to manage and compete effectively. He is co-author of business bestseller First Among Equals (Free Press, 2002), Serving At The Pleasure of My Partners: Advice To The NEW Firm Leader (Thomson Reuters, 2011), and co-leads a bi-annual program entitled: First 100 Days: The New Managing Partner Master Class. McKenna has worked with at least one of the top ten largest law firms in each of over a dozen different countries on issues associated with strategic planning and differentiation, initiating change, client service excellence, and effective firm management.

Jim Hassett is the founder of LegalBizDev (www.legalbizdev.com), which helps law firms increase profitability by improving project management, business development, and alternative fees. He is the author of ten books, including the second editions of The Legal Project Management Quick Reference Guide, and The Legal Business Development Quick Reference Guide. He has also published more than 80 articles in the New York Times Magazine, Of Counsel, Legal Management, Strategies: The Journal of Legal Marketing, and other publications. Jim is a frequent speaker at law firms, the New York City Bar, the New York State Bar, the Massachusetts Bar, Harvard Law School, the Association of Corporate Counsel, the Defense Research Institute, and the Legal Marketing Association.

Bruce MacEwen is a lawyer and consultant to law firms on strategic and economic issues—as well as founded and President of "Adam Smith, Esq." (AdamSmithEsq.com), which is both a publication covering the economics of law firms and a management consultancy to sophisticated law firms on issues including strategy, finance, compensation, globalization, and the consequences of the “Great Reset” as well as the industry trend towards increasing segmentation. Bruce has written for or been quoted in: Fortune; The Wall Street Journal; The New York Times; The Washington Post; Bloomberg News/Radio/TV; Business 2.0; and other publications too numerous to mention. He is a sought-after speaker.

Reserve your Webinar seat now at: http://usa.ark-group.com/events-details.aspx?eid=89

Post #576 – Wednesday, November 23, 2011

Now Here’s A Memorable Interview

I was reading through a magazine published exclusively for CEOs when I came across this interview with the managing partner of a major US-based law firm. Here is an excerpt:

Question: What has allowed [your firm] to remain strong during the last few years of intense challenge?

Answer: It’s not just one thing. We have always put our culture and the delivery of value to a wide range of clients at the very top of our priorities. And we never forget the critical importance of carefully managing the business, controlling our costs, and sticking to our balanced business model, which allows us to steadily navigate all of the changing cycles better. Our financial stability and closeness to our clients and markets, as well as our entrepreneurial streak, emboldened us to look ahead while others were engaging in massive layoffs and squeezing profits from headcount and expense reductions as they saw revenues drop. With our revenues reaching their highest levels during 2010 and the first six months of 2011, we used the downturn to become stronger in quality, service, and in our overall value proposition, with clients and lateral shareholders drawn by our stability and clear message. During this period, we added shareholders and opened offices led by top quality individuals in their markets.

Question: You talk a lot about your culture. What makes it so unique?

Answer: Our culture is first and foremost about putting the right people on the bus and doing our best to maximize the collaboration, closely watch the quality, fairly reward our people, and otherwise stay out of their way. While most large law firms are bureaucratic and internally political, we have always remembered that our single purpose is to satisfy clients with internal policies and procedures geared towards doing so. This means remaining nimble, responsive, and collaborative, while empowering individuals on the ground who are closest to the clients to come up with the great ideas and lead the execution of our initiatives. Fairness, trust, and integrity are also critical around here, our “secret ingredients,” allowing decisions to be made fairly and in the best interests of our clients and firm. We are also independent thinkers – how and when we have grown both in and out of the U.S., the balanced practice and location model and the aversion to mergers and other culture-sacrificing means of expedient growth, all mark our firm as truly following its own path, thinking for itself, and preserving its culture.

So, this mystery firm is unique because it is “putting the right people on the bus” (thank you Jim Collins for this latest tripe); “satisfying clients with internal policies and procedures geared towards doing so” (now that should really narrow down your guess as to who this is); has a secret ingredient of “allowing decisions to be made fairly;” and finally are “independent thinkers” (ahhh, the ultimate differentiator).

This was only half the interview and in all fairness I could have included the next three questions and answers, but trust me . . . it doesn’t get any better. So, which law firm do you think this leader is from? Or, even better, can you please name a law firm that you seriously don’t think fits this vanilla description? This was only half the interview and in all fairness I could have included the next three questions and answers, but trust me . . . it doesn’t get any better. So, which law firm do you think this leader is from? Or, even better, can you please name a law firm that you seriously don’t think fits this vanilla description?

What really hurts is that this law firm leader would absolutely waste, highly valuable space, in a premiere publication that CEOs obviously read to deliver such an unmemorable, unremarkable message. OUCH!

Post #575 – Thursday, November 17, 2011

The ACC Value Index Tiger Is Being DeClawed

I received a note from the managing partner of AmLaw firm last night at my hotel asking me what I know about a letter they received. He said, it looks like "the ACC tiger has just been de-clawed." Here's the substance of the letter: I received a note from the managing partner of AmLaw firm last night at my hotel asking me what I know about a letter they received. He said, it looks like "the ACC tiger has just been de-clawed." Here's the substance of the letter:

I am writing to let you know that the ACC Value Index (AVI) will come to a close at the end of the year. As of today, the AVI will no longer be accepting new law firm reviews. However, it will remain open for viewing through the end of the year. As a reminder, to access your firm's review results, visit www.acc.com/valuechallenge/valueindex/lawfirmaccess.cfm.

Upon closing the ACC Value Index, we will issue a report sharing insights learned from client reviews. For example, did you know that efficiency and predictability of spending can be as important to your clients as legal expertise? Or that taking the time to understand their business is critical to customer satisfaction?

These insights and more will be available in the full, end of year AVI report and accessible through the ACC Value Challenge section of the website. In the meantime, feel free to access your firm's review results through December 31. If you have any questions or comments, please call or email Catherine J. Moynihan

WOW! WHAT IS WITH THAT???

Well, according to a General Counsel source close to the situation . . . indications are that the real reason for dropping it is lack of interest and attention from the ACC members themselves.

Meanwhile a new study out of the UK reports that: Fewer than half of general counsel are taking steps to drive down legal spend, despite the fact 80% acknowledge the importance of being more cost-effective, according to new research.

So, what does all this tell you?

Post #574 – Saturday, November 5, 2011

The Collapse of Realization Rates Amidst Increasing Expenses

I’m surprised to observe that while firms managed a 3 to 4 percent increase in their billable rates during the year, actual realization seems to have plummeted in many firms. It used to be that 95-96% was the target and 92-93% was the base result for good law firms as the rate of collection on A/R outstanding. There is emerging a picture that the current environment could be more like 82-83% actual realization rates – and in some instances (one AmLaw 50 firm) even less. As it was pointed out to me, a ten percent drop in gross collections rate means a 25% drop in net distributable income, rough and dirty. It’s not happening for all firms. But if what I'm observing is any indication, it seems to be happening to quite a few. I’m surprised to observe that while firms managed a 3 to 4 percent increase in their billable rates during the year, actual realization seems to have plummeted in many firms. It used to be that 95-96% was the target and 92-93% was the base result for good law firms as the rate of collection on A/R outstanding. There is emerging a picture that the current environment could be more like 82-83% actual realization rates – and in some instances (one AmLaw 50 firm) even less. As it was pointed out to me, a ten percent drop in gross collections rate means a 25% drop in net distributable income, rough and dirty. It’s not happening for all firms. But if what I'm observing is any indication, it seems to be happening to quite a few.

In discussions with my good friend Ed Resser, he responded by suggesting that many law firms may be “gaming” their realization reporting in a similar manner to how they gamed their PPP numbers until Citiback threw a wet blanket on the prevarication in the published reports. Ed reports that:

“Law firms are ‘gaming’ realization reporting and claiming that ‘discounted’ rate work that is collected as agreed is . . . full realization. So here is a great way to throw out a number that gives a false reading as a reflection of operational health, that cannot be corroborated.

The light bulb of the importance of realization is now going off on in the heads of recruiters and lateral partner candidates who are aware that it is important and want to know that the group they are joining has solid clients so that the work portfolio they bring of high paying clients is not ‘diluted’ by struggling profitability of the new firm. How does that get accomplished? Easy, with retroactive characterization of post billing write-downs given to clients by accommodating the client demand for a discount as follows: ‘okay, we will reduce our hourly rate for the work already done to $X per hour blended for you, and that gets you the $Y total balance you want to pay. Is that ok?\’ The client could care less what the firm is proposing as a method, they just want the discount to a sum certain, and at year-end especially they get it. Then the firm says: Great, we report we got 100% realization on that one, characterize it as AFA and say that to the partners. Total nonsense!”

Meanwhile, recent reports indicate that while rates strengthened slightly during the third quarter of this year, the demand for legal services weakened. And, more significantly, the rise in expenses continues to accelerate. In the third quarter, increases in expenses ran well ahead of slowing revenue growth, sharply curtailing profitability. As 2011 has evolved, costs have steadily accelerated to the point where they are now easily outpacing both demand and rate growth.

And as if that wasn’t enough there is every indication, as expressed by various General Counsels in recent interviews, that there is an increasing shift for companies to bring even more legal work in-house. As one General Counsel expressed it, “In-house counsel who work closely with their business units have the opportunity to be forward-looking in a way that outside firms do not.”

Ed and I don't believe that any law firm can sustain 80% realization performance, increasing expenses and declining demand – before it goes down to its knees amid the pack of wolves known as recruiters. BE WARNED: These last two months could become one of the most furiously busy interviewing seasons the lateral partner market has witnessed for some years.

Post #573 – Saturday, November 5, 2011

What’s Your ACC Value Index Score?

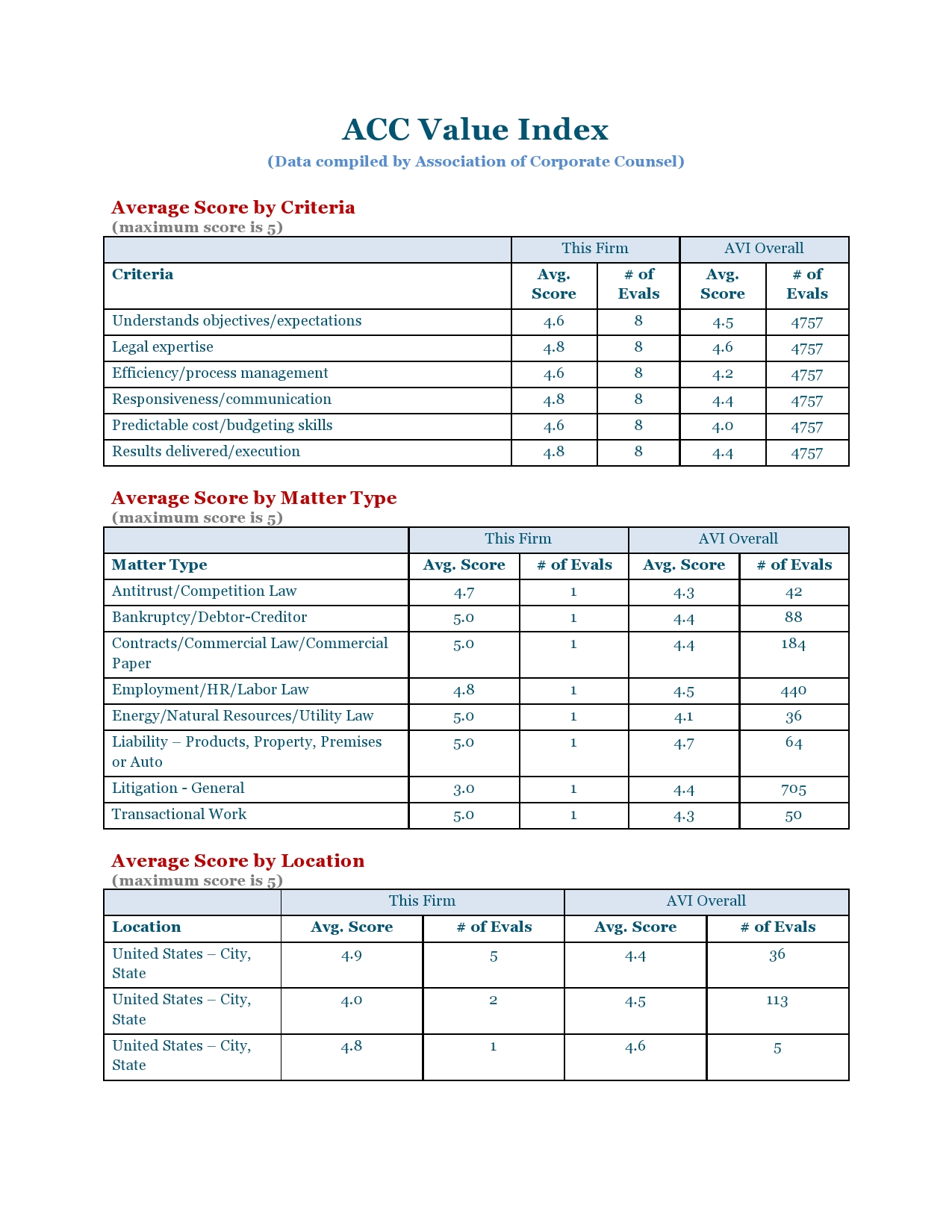

I attended and presented at a session of managing partners awhile back where a representative from the ACC was also a presenter. During part of her comments she referred to their Value Index initiative where in-house counsel are invited to score and post evaluative comments about the outside law firms that they utilize.

“The ACC Value Index is a client satisfaction measurement tool that helps ACC members share meaningful information about the value they get from their outside counsel. It is a component of the larger ACC Value Challenge initiative, reconnecting the cost of legal services to the value provided.”

What was particularly interesting was that she informed the audience that thus far over 1300 law firms (far beyond just the AmLaw 200) had now received assessments and that these law firms were the recipients of anywhere between 3 to 50 evaluative comments.

Now, I got the strong impression that the ACC is pushing their membership to use this Value Index as their primary source (rather than Chambers or Martindale or whatever) of information about outside law firms. If you think about it you have a good number of in-house contacts that are very loyal to your firm. It may well be worth investing time in a concerted campaign to (1) identify your most loyal clients, (2) have one of them obtain your firm’s scorecard so that you can see how you rate, and (3) methodically, one-by-one have a discussion with each of your best clients about whether it would be comfortable for them to log-on to the ACC Value Index and offer a testimonial about their experience with working with your firm.

I don’t think that many firms have yet to take this ACC initiative very seriously. This may be a wonderful way to influence prospective clients. Here is what an ACC Value Index Scorecard actually looks like:

Post #572 – Tuesday, November 1, 2011

Low Return

Financial incentives are The Am Law 200's favorite motivational tools, but their value is limited, and they carry risks. My co-authored article (with Ed Reeser) in this month’s issue of American Lawyer highlights the half-dozen most dire and unintended consequences that result when monetary incentives are overused. Financial incentives are The Am Law 200's favorite motivational tools, but their value is limited, and they carry risks. My co-authored article (with Ed Reeser) in this month’s issue of American Lawyer highlights the half-dozen most dire and unintended consequences that result when monetary incentives are overused.

Law firm leaders and management committees expend vast energy in pursuit of the Holy Grail of the perfect blend of incentives, positive and negative, to stimulate attorney behavior. That pursuit is premised on deeply held assumptions concerning how much money motivates people, and a belief that if they can just get the compensation scheme right, attorneys will then behave in whatever manner management dictates.

Money does motivate us. Professionals need to feel that their compensation is commensurate with their contributions and that they are equitable relative to what other professionals are earning. Financial rewards can be used as a way to express appreciation and acknowledge a job well done, but the more you use money as a motivator the more likely it is that you will have negative effects.

Performance-related compensation, bonuses and many other incentives are designed by law firms to encourage lawyers to work harder and do (or not do) certain things that management determines would increase performance. However, obsessing about money and believing it to be the primary answer to managing your fellow partners, may also be one area wherein many firms have experienced the most dire, unintended consequences.

There is ample evidence to suggest that compensation and behavior are far more complicated to understand than simply thinking that if one provides a lucrative carrot, or gnarly stick, people will do whatever management wants.

Page << Prev 30 31 32 33 34 35 36 37 38 39 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8