|

http://www.patrickmckenna.com/blog

Page << Prev 40 41 42 43 44 45 46 47 48 49 Next >> of 95

Post #530 – Wednesday, March 16, 2011

A BS Detector’s Review of the Latest Howrey News

A good friend of mine served on the executive committees and as an office managing partner of firms ranging from 25 to over 800 lawyers in size. He is an early riser, avid reader and loves to translate what is really going on behind the latest legal news. A couple of us have badgered him about getting his own blog as we sincerely believe that it would be among the best read in the industry. But . . . he’s shy. So, with his permission, I’m publishing his latest interpretation of today’s news concerning Howrey. I’m sure that you will find his commentary most enlightening: A good friend of mine served on the executive committees and as an office managing partner of firms ranging from 25 to over 800 lawyers in size. He is an early riser, avid reader and loves to translate what is really going on behind the latest legal news. A couple of us have badgered him about getting his own blog as we sincerely believe that it would be among the best read in the industry. But . . . he’s shy. So, with his permission, I’m publishing his latest interpretation of today’s news concerning Howrey. I’m sure that you will find his commentary most enlightening:

Howrey's End Wasn't Foregone Conclusion

Posted by Brian Baxter

When Latham & Watkins partner Peter Gilhuly was contacted by Howrey managing partner and chairman Robert Ruyak last December to advise the troubled firm on its options, dissolution wasn't part of the initial discussion.

(So, they just hired the leading expert in the country for large law firm dissolution, a bankruptcy practice specialist, for his ability to advise on how to help guide a firm with a business model that works, even though more than 100 partners have left and distributable income is on track to be half of the prior year.)

"Very few firms think they're going to dissolve when you talk to them, so they don't hire you for that purpose initially, although they're aware of it as a possibility down the line," Gilhuly says. "Typically what happens is they have an issue with their bank and they're looking for advice on a broad scale of issues."

(So, law firms hire bankruptcy specialists to advise on line of credit financing. Is there any possibility that there is a concern that admitting to insolvency in December might be an admission that would require disgorgement of all of the distributions in January? Or that draws on the bank line of credit might be constructive fraud on the bank for which some partners might have personal liability?)

In time, as a firm's troubles grow deeper, Gilhuly's role often expands. That's what happened with Howrey. The firm had a rough year in 2010 with fading financials and fleeing partners. Given his background advising on the wind-down efforts of Thelen, Darby & Darby, and Brobeck, Phleger & Harrison, Gilhuly had the requisite expertise to counsel Howrey on its increasingly limited options.

(Now that it is clear you have leaped from the top floor of the building, let's talk about action options. But first, a few words about terminal velocity and the comparative density of your body and the sidewalk.)

It didn't take long before Gilhuly--and the Howrey lawyers who turned to him for help--realized that Howrey faced problems similar to those that plagued other recently defunct firms. As Gilhuly became more entrenched in the business of the firm, examining its books, and talking to its partners, he noticed that Howrey's focus on litigation had left the firm exposed in the aftermath of the economic downturn in late 2008.

(Ooooooooo, here it comes......wait for it.......alternative fees and low cost service providers unexpectedly arose and killed a healthy, well run law firm!)

To read the complete behind-the-scenes analysis of this article - download the PDF.

RELATED POSTING:

Pat Lamb, in his fabulous blog, In Search of Perfect Client Service continued on this theme with another commentary from our mtutal friend - "Here's the the same anonymous insider's view of the Journal article Law Firm Howrey to Hold Dissolution Votes. As Patrick McKenna did, I am copying key parts of the article with our anonymous ex-insider's comments in bold." Have a read.

Post #529 – Thursday, March 10, 2011

Practice Group Strategy Forum

Join me May 19 in New York when I will be both chairing and presenting at the Ark Group / Managing Partner Magazine’s 5th Annual Practice Group Forum featuring Lisa Damon the primary architect of Seyfarth Shaw’s version of Lean Six-Sigma, Steve Levy author of Legal Project Management, the extraordinary blawger Bruce MacEwen and numerous notable panelists from distinguished firms like Dechert, Haynes and Boone, Sidley Austin, Williams Mullen and Levenfeld Pearlstein.

You may download a copy of the program here.

If any of you are planning to attend, shoot me an e-mail and maybe we can get together for a cappuccino.

Post #528 – Tuesday, March 1, 2011

Confronting Firm Complacency

Three years ago, together with Baker & Daniels Chair Emeritus Brian K. Burke, I co-founded what is now known as The LAB (the Managing Partner Leadership Advisory Board) – a forum designed to provide recently appointed managing partners with a source for obtaining pragmatic advice on their leadership questions and critical burning issues. The formation of this group was the result of suggestions made during our bi-annual First 100 Days master class for new managing partners and has proven to be a valuable resource for new leaders. Three years ago, together with Baker & Daniels Chair Emeritus Brian K. Burke, I co-founded what is now known as The LAB (the Managing Partner Leadership Advisory Board) – a forum designed to provide recently appointed managing partners with a source for obtaining pragmatic advice on their leadership questions and critical burning issues. The formation of this group was the result of suggestions made during our bi-annual First 100 Days master class for new managing partners and has proven to be a valuable resource for new leaders.

Here is the latest question in a series of some twenty different queries that The LAB members have now responded to:

I am slated to become our firm’s next managing director. In now looking at what lays ahead, I realize that many firms have begun to confront the challenges of tomorrow – adopting alternative fee arrangements, outsourcing, social media, new IT capabilities and so forth. While our firm has been financially successful, I fear that my colleagues have become somewhat complacent. How would your group suggest I approach this situation with my partners, when I assume leadership of this firm?

Read: Confronting Firm Complacency

The LAB responses derive from its members' many years' experience as law firm leaders. Along with Brian and I, the LAB is comprised of the following distinguished current and former law firm leaders: Angelo Arcadipane (Dickstein Shapiro LLP); John Bouma (Snell & Wilmer LLP); Ben F. Johnson, III (Alston & Bird LLP); Keith B. Simmons (Bass Berry & Sims PLC); William J. Strickland (McGuire Woods LLP); Harry P. Trueheart, III (Nixon Peabody LLP); R. Thomas Stanton (Squire Sanders); and Robert M. Granatstein (Blake Cassels and Graydon).

Post #527 – Saturday, February 19, 2011

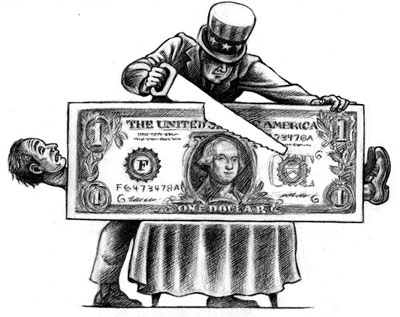

Warning: Inflation May Be Closer Than It Appears

Back on November 18, 2007, I posted a blog asking: “Is The Financial Day Of Reckoning Close At Hand?” (Post #254) suggesting that the collapse of the real estate market was getting close. I will now go on record as predicting that this is the year when inflation will begin to have a negative impact. Back on November 18, 2007, I posted a blog asking: “Is The Financial Day Of Reckoning Close At Hand?” (Post #254) suggesting that the collapse of the real estate market was getting close. I will now go on record as predicting that this is the year when inflation will begin to have a negative impact.

I use the term "inflation" here as the man on the street does. It is simply when prices for some of the basic necessities (food and energy) continually go up. That’s not the best definition, as it obscures why prices go up in the first place . . . and the reason is that governments everywhere can't help but print scads of money.

For example, the World Bank's latest data on food prices reveals an overall 15% increase from October through January. According to their data, global wheat prices have doubled between June and January 2011. The price of corn - which is used to feed the cattle, hogs and chickens that populate the meat shelves at your local grocery store - has surged 73% in the same period. Prices for sugar and edible oils have also risen "sharply.”

"Global food prices are rising to dangerous levels and threaten tens of millions of poor people," World Bank chief Robert Zoellick announced earlier this week. In India, food prices are at their highest levels in more than a year, rising 18%. In China, the typical Chinese also faces rising prices for nearly everything. The official inflation rate recently hit a 28-month high. But it's the surging price of coal that may prove to be China's Achilles' heel, at least in the short term. Coal is what powers the great boom in China. And coal is at two-year highs. I would suggest that the basics like food and energy will serve to dramatically slow the growth of these economies in 2011.

Inflation will likely get much worse, if history is any guide. I’m sure many of you remember the inflationary experience of the 1970s. The official inflation rate hit nearly 14% by 1980. In other countries, it was worse. In the UK, inflation topped out at 27%; in Japan, 30%.

In the U.S. wholesale prices jumped 0.8% in January. The producer price index (PPI) has now jumped 3% over the last four months. And that's not an annualized figure. Note that this PPI number is for "finished goods" - stuff that's ready to be sold direct to consumers. In the category of "crude goods," the figures are far worse - up 3.3% in January, and up a staggering 15.8% over the last four months.

Meanwhile, numerous reports from large multi-national companies indicate very clearly that inflationary pressures are building. Here's a sample:

DuPont & Co. - "DuPont forecast raw-material and freight costs to be some 4% to 5% higher this year than last."

Procter & Gamble - "P&G, which sells everything from Tide detergent to Olay skin-care products, said its commodities bill will cost $1 billion for the fiscal year that ends in June, more than double what it had expected." Procter & Gamble - "P&G, which sells everything from Tide detergent to Olay skin-care products, said its commodities bill will cost $1 billion for the fiscal year that ends in June, more than double what it had expected."

Colgate-Palmolive - "Colgate's profit fell [in the fourth quarter] 1%...squeezed by higher commodity costs and money paid to promote its products."

3M Company - "Margins declined under rising material costs and weakening sales in the company's health care and graphics businesses... 3M said it intends to recover higher material expenses through price increases."

Pepsico - Hugh Johnson, Pepsi's CFO, talked about cost inflation of 8% to 9.5%: "That type of inflation has a pretty strong impact."

Goodyear - "Raw material prices costs are likely to rise 25% to 30% in the first quarter of 2011 and rubber prices have risen 40% since October 2010."

Whirlpool - It is "seeking to offset cost increases for such items as steel, copper and plastics..."

Electrolux - "The costs for our most important raw materials continue to increase," Electrolux CEO Mr. McLoughlin, said in a statement. "In addition to increased costs for steel, we also see considerable increases in resins (used in plastics) and base metals."

After reading these, do you know what impact your clients are currently experiencing?

For his part, the man printing all the money chasing these commodities, Fed Chairman Ben Bernanke, flatly denies any wrongdoing. The trillions of dollars he has injected into the world's economy have nothing to do with the escalating price of commodities, he contends. When asked about the impact of QE2 on global food prices, Bernanke responded that the destabilizing spikes are due to weather and rapid growth in demand for grains in emerging markets. As an admirer of Milton Friedman, he must know that "inflation is always and everywhere a monetary phenomenon."

As inflationary pressures build, forward-looking firms will want to start preparing. But that means that forward-looking managing partners will need to ignore all the assurances from Washington and Wall Street that "everything is under control." The latest testimony from the titans of global commerce demonstrates very clearly that Bernanke's promised "very low" inflation is starting to become uncomfortably high.

COMMENT RECEIVED (February 21):

And the question that then must immediately be asked is......."and what does this mean for legal service providers?"

In a nutshell, as against an already suffocating clamp on the revenue growth side that law practice depended on until late 2007, after which it was impossible to implement, there will be a powerfully resurgent rise in operating costs that cannot be controlled. The same "stuff" is just going to cost more. If we thought the pain was bad with the iron ceiling against rate increases and the adjustments made to preserve partner income levels (or more appropriately, the income levels of some partners), the squeeze to come now from the uncontrollable increases on the expense side is going to approach dental extractions without the benefit of anaesthesia.

This would be challenging enough with significant improvements in operations and efficiencis. But as we have seen, most firms have engaged in no such modifications. Almost everything has been other than true operational reform to improve efficiency. This is going to shorten the time component of getting it done. Stick with it, or start fresh, is going to be the question that comes to the top of the agenda for a lot of partners and firms this year. Edwin Reeser

Post #526 – Friday, February 18, 2011

People Handling Delusions

A twenty-year study of leadership effectiveness conducted by Stanford University’s School of Business concluded that about 15% of one’s success in leading organizations comes from technical skills and knowledge, while 85% comes from the ability to connect with people and engender trust and mutual understanding. The problem however lies not in this remarkable data, but with those who think they already have what it takes. A twenty-year study of leadership effectiveness conducted by Stanford University’s School of Business concluded that about 15% of one’s success in leading organizations comes from technical skills and knowledge, while 85% comes from the ability to connect with people and engender trust and mutual understanding. The problem however lies not in this remarkable data, but with those who think they already have what it takes.

The real issue lies in delusional thinking about our people-handling competence. Reality likely belies your self-assessment. Over 96% of leaders today believe they have “above average” people skills. This is a statistical improbability. It is what psychologists call motivated reasoning, which means that once we decide something is true (for whatever reason) we make up reasons for believing it to be true. Most of us believe we are smarter, fairer, more considerate, more dependable and more creative than average. But we cannot all be “above average.”

This is not behavioral; it is neurological – it is hard-wired into the brains of normal, healthy people like you and me. Studies confirm that 75% of North American leaders believe they are “better” than others in their industry - thus, 90% of physicians, investment bankers, and lawyers (specialists who cannot afford to second-guess their decisions) rate themselves in the top 10% of their field, and 94% of university professors say they are above average teachers. Simply put, successful people are incredibly delusional about their skills and, as Andy Grove (retired Chair Emeritus of Intel) once advised, “Success breeds complacency and complacency breeds failure.”

The most important leadership skill is the ability to genuinely listen to people. Most of us assume we do this quite naturally. Think again. Research confirms that the listening proficiency level of over 95% of people tested falls between 17 and 29%. (And our tendency to think we are good at multi-tasking is likely fast reducing those percentages.) Listening is a skill. It can be learned and therefore improved. Unless, like others, you assume you are “above average” and don’t require such training – a choice that may be ego gratifying but also delusional!

Post #525 – Friday, February 18, 2011

Clients Say The Nicest Things

It should go without saying that all of us enjoy being appreciated. I have always been eager to work with nice people who are committed to improving their practices and their firm. That is, by far, my greatest motivator.

To that end, one of my clients is a firm with over 100 lawyers and government relations professionals focused on energy, environment and natural resources. This particular firm is a recognized top-tier Washington DC powerhouse and described by Chambers as “the best energy boutique in the U.S.” I was genuinely impressed to receive this kind (unsolicited) note from a member of the firm’s executive committee:

Thank you for taking the extra time with us. It was very interesting and informative, and your teaching continues to reverberate positively around the firm. In so many ways, large and small, we became better and more focused through those sessions.

I took your advice and read the material on your website. It is extraordinarily helpful --- straightforward, real-world and hard-won experience --- made more helpful by your analysis. Thank you for assembling it and providing it.

For my part, I would recommend you and your insights to anyone who asks or needs wise counsel on business development and management.

Richard A. Agnew, Office Managing Partner – Van Ness Feldman

Post #524 – Monday, February 14, 2011

Signal What You Value As A Leader

One of the more profound things that I learned, that I try to pass along to new leaders, be they managing partners or practice heads is to “act like you are on stage at all times, because you are!” Everything you do and say will send messages, set tone, establish expectations, and communicate direction about what is of priority to you. With that in mind, you need to carefully orchestrate what symbolic acts you may want to execute to create a lasting impression and convey what you stand for. In other words, you need to always think through: One of the more profound things that I learned, that I try to pass along to new leaders, be they managing partners or practice heads is to “act like you are on stage at all times, because you are!” Everything you do and say will send messages, set tone, establish expectations, and communicate direction about what is of priority to you. With that in mind, you need to carefully orchestrate what symbolic acts you may want to execute to create a lasting impression and convey what you stand for. In other words, you need to always think through:

• Where You Spend Your Time.

The primary thing that your partners will always look to is where and how you spend your time. Leaders spend time on whatever issues they think are most important. Examine your day-timer, compare it against the actual activities that consumed your time during just this past week and identify for yourself what your activity says to your colleagues about what you see as your most important priorities? Now, what do you want ‘your time spent’ to say about your priorities in the coming months.

• What You Inquire About.

Leaders who are successful are mindful to walk the job rather than get stuck in their offices. They ask lots of questions and listen loudly. The questions you deliberately ask and the attention those questions provoke sends a clear signal about the prevailing themes that occupy your thinking. Are the questions you want to ask of your partners and the topics you plan to focus in on consistent with the signals that you want to convey?

A classic and often misquoted study by Dr. Mehabrian from the University of California stated that the total impact of any message is based 7% on the words used; 38% on the volume and tone of one’s voice; and fully 55% on facial expressions and other body language signals. But, Dr. Mehabrian never claimed that you could view a movie in a foreign language and accurately determine 93% of the content by simply watching people’s body language. What is important to consider as a leader, is that the non-verbal aspects of your communication will reveal to people your underlying emotions, motives and feelings. Your colleagues will evaluate the emotional content of your message, not by what you say or what you inquire about; but by how you say it and how you look when you say it.

• How You Spend Your Budget.

What we purposely budget for and the way in which we choose to spend our money says a lot about our priorities and our values. What will your 2011 budget expenditures tell people about where you are focusing your leadership attention?

• What Specifically You Measure.

Usually an important indicator of what you think is important is specifically what you measure, what you generate written reports on, and what you track on a regular basis. If you say, that as a practice group or as a firm, we should be more focused on delivering value to our clients, are you rigorous about looking for more efficient ways to execute your deals and transactions; and constantly measure improvements in efficiency? Are you measuring the quality of the services provided and the client’s satisfaction?

• What You Celebrate and Rebuke.

Will what you publicly reward, those behaviors you identify and successes you celebrate within the firm reinforce the values and priorities that you as a leader are trying to emphasize? When one of the partners takes a measured risk with the intent of benefiting the firm and their actions fall short, is there a history of that partner being rewarded for their initiative or reprimanded for their failed efforts?

Again, I’m reminded of the words of one exemplary firm leader who counseled: “I learned that little gestures had significance. Everything you do is magnified, and you have to realize that. Even if you are a bit worn down, smile. People derive a lot of their outlook from the outlook of their leaders, and it makes them feel good if you appear in good spirits.”

The above represents my latest column for Slaw. Slaw identifies itself as “a cooperative weblog on all things legal.” Slaw has been publishing for five years and gets 30,000 unique visitors and about 100,000 visits every month. For the past two consecutive years it has been the winner of three different awards as the best legal blog. I’m honored to have been asked to become a regular columnist and invite you to comment on my latest meandering.

Post # 523 – Sunday, February 13, 2011

The Perils of Lateral Recruitment

In my strategic planning counsel to firms over the past couple of years I cannot think of one that has not adopted an aggressive approach to lateral recruitment as one of their core initiatives. That said, everyone appreciates that lateral recruitment has become a perilous exercise fraught with missteps and expensive mistakes. Now there are finally some hard statistics out of London that evidence just how badly some are performing with their lateral efforts. In my strategic planning counsel to firms over the past couple of years I cannot think of one that has not adopted an aggressive approach to lateral recruitment as one of their core initiatives. That said, everyone appreciates that lateral recruitment has become a perilous exercise fraught with missteps and expensive mistakes. Now there are finally some hard statistics out of London that evidence just how badly some are performing with their lateral efforts.

New research, conducted by Motive Legal Consulting, reviewed the performance of lateral partner moves that took place between 1 September 2005 and 31 July 2010. Motive analyzed the fates of 1,944 lateral partner moves over this five-year period, asking one simple question: “Was each individual partner lateral hire made during that period still at the firm they had joined?”

The results were startling. Within three years of joining, a third of all partners had moved on. And after five years that jumped to 44 per cent.

By some distance the poorest performers were US firms. Over five years US firms in London took on 540 partners. In certain core areas, such as finance, 45 per cent of these partners had left their firms by July 2010. The immense cost of hiring alone should be a warning as to the importance of these figures. One senior HR director estimates that the average cost per hire at his firm is £150,000.

Mark Brandon, founder of Motive and author of the research, says the results highlight two themes: in many cases hiring partners laterally simply does not work; and US firms are worse at it in London than their UK counterparts. Brandon claims that many firms are hooked on the idea that a ’white knight’ in the form of the perfect candidate is out there somewhere. They presume that their white knight will provide all the answers they need.

As this research suggests, law firms need to do more strategic thinking and more business planning, not just turn to lateral hiring as a quick fix.

COMMENT RECEIVED:

It has been my experience, for the most part, that firm's don't scrutinize laterals or even merger candidates with sufficient diligence. They "decide on emotion" and move the facts around to make it work (not always, of course, but in some cases). Then, once the new lateral is in the door, it's sink or swim. A strategic plan for making the most out any synergies is too often missing. And, as one new lateral once told me, "I wish just once someone would offer to introduce me to their client instead of wanting to be introduced to mine." Also, the internal dog and pony shows focus on "here's what you should know about me," when a better result could be gained by each side focusing on learning as much as possible about the other. Linda Hazelton

Post #522 – Tuesday, February 1, 2011

Being The Subject of A Harvard Case Study

Over the course of a career, if one is terribly lucky, you have a few very special highlights. And I have been enormously blest to have enjoyed quite a few. One of those was having the opportunity of working with my good friend David Maister in collaborating and writing a book that was very kindly critiqued and subsequently translated into nine different languages.

Another occurred a few months ago when I was unexpectedly approached by an MBA student from Harvard. He graciously wanted me to be the subject of a case study that he would research and document for his course on Leadership In Law Firms. Another occurred a few months ago when I was unexpectedly approached by an MBA student from Harvard. He graciously wanted me to be the subject of a case study that he would research and document for his course on Leadership In Law Firms.

"I am studying at the Harvard Law School, have read your work over the years, and in particular enjoyed First Among Equals. I have a proposal for you! My big assignment is to write a great case study and I would like to sound you out to see if I could do it on you."

A couple of months later and following many e-mail exchanges and telephone discussions, here is a PDF of Nick’s work – Innovations In Legal Consulting. Kudos Nick!!!

Now, we are both intrigued to see just how the Harvard Law School faculty might utilize this particular case.

COMMENT RECEIVED:

Patrick, what a great case study and a tribute to your innovative thinking. I just noticed that the attorneys at Milbank Tweed have announced that they will be starting an eight-day, annual training session focused on business principles at Harvard Law. The program is being developed by the firm and Harvard Law professor Ashish Nanda, executive director of the school's executive education program. Milbank may be the first to read all about you as part of their leadership training.

TTM, Managing Shareholder

Post #521 – Tuesday, February 1, 2011

New Report For Practice Leaders

I’m honored to have contributed to a new 100-page report, publish by Managing Partner Magazine and Ark Publishing entitled Strategy Development for Practice Group Leaders. I’m honored to have contributed to a new 100-page report, publish by Managing Partner Magazine and Ark Publishing entitled Strategy Development for Practice Group Leaders.

The practice group leadership role has changed dramatically over the past couple of years. Those who have survived the economic downturn have had to not only hold the fort, but to rebuild business and capitalize on the opportunities arising out of an easing but still uncertain economic landscape. .

Strategy Development for Practice Group Leaders, looks at the role of the practice group leader within the context of this more difficult and changing environment, in which the practice group leader needs to be fully engaged not only with the demands of his or her own team, but also with the practice group’s position within the changing strategy of the business as a whole. The overriding theme is how practice group leaders can support their teams to be both flexible and resilient to accommodate rapidly changing market forces – while also supporting the development needs of individual lawyers. The report reflects the fact that the practice group leadership role has become a daunting but critical component of overall law firm profitability.

Contents:

PART ONE: STRATEGY DEVELOPMENT FOR PRACTICE GROUP LEADERS

Chapter 1: The practice group structure

Chapter 2: Practice group leadership in the context of culture

Chapter 3: Practice group financial management

Chapter 4: The 21st century practice group leader

PART TWO: CASE STUDIES

Case study 1: How to be a successful practice group leader

Case study 2: The answer is evolution

Case study 3: The importance of culture

Case study 4: Empowering the practice group leader

Case study 5: Retaining and promoting women lawyers

Case study 6: A role model for female practice group leadership?

Case study 7: Global practice group leadership

Case study 8: Leading through change

Case study 9: Managing the matrix

The legal profession has faced the test of a lifetime in recent months and with the economic forecast remaining uncertain, the outlook is by no means assured. Practice group leaders play a pivotal role in the success of their firms – now perhaps more than ever before. Despite the challenges, such times also and inevitably present enormous opportunity to both innovate and excel. For the ambitious practice group leader, now may well be the time to shine.

Page << Prev 40 41 42 43 44 45 46 47 48 49 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8