|

http://www.patrickmckenna.com/blog

Page << Prev 60 61 62 63 64 65 66 67 68 69 Next >> of 95

Post #341 – Monday, September 15, 2008

Feedback From A New Managing Partner

Further to my earlier Post #339, we received a very complimentary e-mail from Steven Wright, Executive Partner at Holland & Knight who was one of the dozen participants at our recent First 100 Days master class for new managing partners. Here’s what Steve had to say: Further to my earlier Post #339, we received a very complimentary e-mail from Steven Wright, Executive Partner at Holland & Knight who was one of the dozen participants at our recent First 100 Days master class for new managing partners. Here’s what Steve had to say:

I thought the course was outstanding. I found the strategic approach to the transition excellent. Specifically, the counterintuitive suggestions such as pursuing a strategic agenda as opposed to a strategic plan.

Similarly, it is counterintuitive to take incremental steps and not hurry to announce the next big program. There is clearly an inclination to show you are in charge rather than to try to gain your partner’s confidence.

Additionally, it is counter intuitive to understand that the announcement of your initiatives for change will have very little effect unless you have run a grassroots campaign from the ground up. Having worked for many politicians this point is intuitive to them, but less intuitive to us attorneys.

Your focus on avoiding self-interest is also very important to underscore, because most successful attorneys are good at self-promotion and making decisions to advance their interests. As managing partner, learning to advance the firm's interest or someone else's interest, and forego your own advancement is challenging.

Another great suggestion is that your communications must be repeated and then repeated again. We tend to think that we are clear thinkers, and articulate positions and ideas for a living, hence we are heard.

Stressing that what a managing partner does is beneath the radar screen is extremely important as I didn’t quite realize that many of my partners would not know what I was doing. This has caused me to start to put together a regular managing partner’s report. For instance, this week I will be to meetings with many of the GE's key legal counsel at a Diversity Summit, will have the Governor of Massachusetts in our offices for a fundraiser, will travel to an ABA client-rich, environment midweek, and then will address representatives from all the major law firms in the city next Monday. I now know that all of this activity will be beneath the radar screen of my partners if I don't let them know what I'm doing on their behalf.

Finally, the Hogan Assessment was outstanding. It is truly a bonus because while corporations utilize those types of instruments, law firms do not.

Post #340 – Monday, September 8, 2008

Beware The Next Possible Y2K Practice

Many lawyers will remember that investment that was put into developing and marketing Y2K Practices among a good number of prominent firms. In retrospect was it a bad investment? In my opinion not at all. I believe it was a realistic effort by many firms to establish a dominant position in a growing niche and while it may not have realized on it’s aspirations, business is about taking calculated risks.

Meanwhile, many of us are now reading about how some firms have stumbled as a direct result of their supposed overinvestment in the securitization and structured finance bubble. ‘In hindsight the folly of it all seems so obvious,” claimed one commentator in an article I read last week. But once again, I say that these firms took a calculated risk, enjoyed a number of years of above average profitability and now need to adapt to changing conditions. But ain’t hindsight glorious! It makes those who like to point fingers feel so smart. I just wonder why those same commentators aren’t so quick to share their views of where the future opportunities lie.

For my part, I have some definite views that arise from my research and client work that I’m prepared to go on-record with.

Today firms as diverse as Hunton & Williams, Alston & Bird, Baker & McKenzie, Clifford Chance, Latham & Watkins and numerous others have placed significant bets on the growth of a practice in Carbon Trading. A new area of practice, the carbon offset market seems set to take off. A growing number of state emission mandates, such as those imposed in California, are already beginning to create regulatory headaches for some businesses. Federal carbon caps, expected within the next three years, will raise the pain to a whole new level. Today firms as diverse as Hunton & Williams, Alston & Bird, Baker & McKenzie, Clifford Chance, Latham & Watkins and numerous others have placed significant bets on the growth of a practice in Carbon Trading. A new area of practice, the carbon offset market seems set to take off. A growing number of state emission mandates, such as those imposed in California, are already beginning to create regulatory headaches for some businesses. Federal carbon caps, expected within the next three years, will raise the pain to a whole new level.

In 2006, trading volume of carbon offsets, such as Carbon Financial Instruments and Renewable Energy Certificates (RECs), jumped 200 percent in the voluntary markets (primarily the United States). Observers believe that market is now worth at least $100 million. Privately, those same observers talk about a $4 billion carbon-trading market once federal caps are approved.

But hold on a moment.

Is there really a market here or is this the next Y2K that everyone will have seen – ONLY in hindsight? Here are some rather interesting excerpts from an interview with Dr. David Evans, a former climate alarmist. He recites the reasons for this remarkable change of heart:

I devoted six years to carbon accounting when I built models for the Australian Greenhouse Office. I am the rocket scientist who wrote the carbon accounting model (FullCAM) that measures Australia's compliance with the Kyoto Protocol, in the land use change and forestry sector.

When I started that job in 1999 the evidence that carbon emissions caused global warming seemed pretty good: CO2 is a greenhouse gas; the old ice core data; no other suspects. But since 1999, new evidence has seriously weakened the case that carbon emissions are the main cause of global warming, and by 2007 the evidence was pretty conclusive that carbon played only a minor role and was not the main cause of the recent global warming.

There has not been a public debate about the causes of global warming and most of the public and our decision makers are not aware of the most basic salient facts:

1. The greenhouse signature is missing. We have been looking and measuring for years, and cannot find it. Each possible cause of global warming has a different pattern of where in the planet the warming occurs first and the most intensely. The signature of an increased greenhouse effect is a hot spot about 10 km up in the atmosphere over the tropics. We have been measuring the atmosphere for decades using radiosondes: weather balloons with thermometers that radio back the temperature as the balloon ascends through the atmosphere. They show no hot spot. Whatsoever.

2. There is no evidence to support the idea that carbon emissions cause significant global warming. None. There is plenty of evidence that global warming has occurred, and theory suggests that carbon emissions should raise temperatures (though by how much is hotly disputed) but there are no observations by anyone that implicate carbon emissions as a significant cause of the recent global warming.

3. The satellites that measure the world's temperature all say that the warming trend ended in 2001, and that the temperature has dropped about 0.6 degrees Celsius in the past year (to the temperature of 1980).

None of these points are controversial. The alarmist scientists agree with them, though they would dispute their relevance. So far the debate has just consisted of a simple sleight of hand: show evidence of global warming, and while the audience is stunned at the implications, simply assert that it is due to carbon emissions. The world has spent $50-billion on global warming since 1990, and we have not found any actual evidence that carbon emissions cause global warming. When it comes to light that the carbon scare was known to be bogus in 2008, the Australian Labor Party is going to be regarded as criminally negligent or ideologically stupid for not having seen through it.

Because I am paid as a strategist to help law firms identify and develop lucrative new practice areas, I am always diligent to discern whether a supposed emerging practice has real market traction. Beware, this one has some red flags attached.

Post #339 – Wednesday, September 3, 2008

Discern Your Leadership Strengths and Weaknesses

This past week, my friend Brian Burke (Chairman Emeritus of Baker & Daniels) and I had the pleasure of working with a dozen new managing partners at the University of Chicago at out First 100 Days master class. One of the questions that arose is how to accurately determine your strengths and weaknesses in a new leadership role. Here is one approach: This past week, my friend Brian Burke (Chairman Emeritus of Baker & Daniels) and I had the pleasure of working with a dozen new managing partners at the University of Chicago at out First 100 Days master class. One of the questions that arose is how to accurately determine your strengths and weaknesses in a new leadership role. Here is one approach:

Some things you do as firm leader give you energy and some take it away. Some activities strengthen you and some weaken your resolve. Some imbue vitality and while others only stimulate anxiety.

To help identify which are which, take a blank piece of paper, draw a line down the middle and label one side “Vitality” and the other “Anxiety.” During the next week as you busily attend to your responsibilities take this sheet and write down your various activities dividing them between these two categories. In your Vitality column will appear those things that you enjoy doing. These are the activities, projects and endeavors that make you feel fulfilled in your leadership responsibilities. In your Anxiety column will be those tasks that you have difficulty confronting, that you find problematic to concentrate on doing, that you tend to procrastinate over, or things you hope will remedy themselves without you having to do anything.

It is difficult to achieve fulfillment as a firm leader without knowing which activities serve to vitalize you and which require that you draw strength from others more suited to deal with the specific situation.

Post #338 - Thursday, August 28, 2008

Fall 2008 EIR Available

The latest issue of our Edge International Review hit the desks of managing partners this week while I’m here doing my master class sessions at the University of Chicago, and I’ve already received an interesting note from Rod Newing a writer at the Financial Times in London wanting to use a quote in an article that he is writing and will likely be published next week. Thanks Rod. More information to follow. The latest issue of our Edge International Review hit the desks of managing partners this week while I’m here doing my master class sessions at the University of Chicago, and I’ve already received an interesting note from Rod Newing a writer at the Financial Times in London wanting to use a quote in an article that he is writing and will likely be published next week. Thanks Rod. More information to follow.

Post #337 - Thursday, August 21, 2008

Clarifying The Role of Office Managing Partner

Here is a new question posed to the Managing Partner Leadership Advisory Board (the LAB) that I have the honor of Co-Chairing:

"I’m the relatively new managing partner at a regional firm of about 400 attorneys. We have seven decent-sized offices, each with their own Office Managing Shareholder, each spending about 25% of their time on office issues. Over half of these folks were appointed by my predecessor and have been OMS’s for less than two years. As with many firms we’ve been shifting the locus of our operations to a practice group configuration. Embarrassingly, we seem to have ignored this group such that we have never had a separate meeting of our OMS’s for the past ten years. I’m looking to change that and plan a one-day session next month for these folks, but want to make it a "business day" with meaningful activity. Any ideas you can offer for agenda topics? What have the various firm leaders in your group done that has worked effectively for gatherings of this nature?" "I’m the relatively new managing partner at a regional firm of about 400 attorneys. We have seven decent-sized offices, each with their own Office Managing Shareholder, each spending about 25% of their time on office issues. Over half of these folks were appointed by my predecessor and have been OMS’s for less than two years. As with many firms we’ve been shifting the locus of our operations to a practice group configuration. Embarrassingly, we seem to have ignored this group such that we have never had a separate meeting of our OMS’s for the past ten years. I’m looking to change that and plan a one-day session next month for these folks, but want to make it a "business day" with meaningful activity. Any ideas you can offer for agenda topics? What have the various firm leaders in your group done that has worked effectively for gatherings of this nature?"

Read the entire question and response: Clarifying The Role of Office Managing Partner [PDF Version]

The LAB was formed as a resource to provide pragmatic advice to assist new managing partners with their critical burning issues and help them succeed. The LAB is comprised of the following distinguished current and former law firm leaders: Angelo Arcadipane (Dickstein Shapiro LLP); John Bouma (Snell & Wilmer LLP); Brian K. Burke (Baker & Daniels LLP); Ben F. Johnson, III (Alston & Bird LLP); John R. Sapp (Michael Best & Friedrich LLP); Keith B. Simmons (Bass Berry & Sims PLC); William J. Strickland (McGuire Woods LLP); Harry P. Trueheart, III (Nixon Peabody LLP); together with Patrick J. McKenna.

Post #336 – Tuesday, August 12, 2008

In The Company Of Leaders

I am honored to be included amongst the likes of Jim Cathcart, Marshall Goldsmith, Mark Sanborn, Jack Trout, Brian Tracy and other international bestselling authors and noted authorities on leadership in a new book to be released this week, entitled: In The Company Of Leaders, edited by my good friend Bob Hooey. I am honored to be included amongst the likes of Jim Cathcart, Marshall Goldsmith, Mark Sanborn, Jack Trout, Brian Tracy and other international bestselling authors and noted authorities on leadership in a new book to be released this week, entitled: In The Company Of Leaders, edited by my good friend Bob Hooey.

Bob will formally launch this book during his Key Note Luncheon Address at the upcoming Toastmasters International Convention being held in Calgary, Canada this Friday, and it will then become accessible to the general public.

“We hope it will grow legs as it reaches out across the 93 countries represented by Toastmasters International in helping equip and motivate thousands of Toastmasters and their circle of influence to claim their personal leadership and hone their leadership skills,” claimed Bob. “I am so thankful to our amazing authors and experts for their willingness to help us create this work. I am humbled by their generosity.”

Post #335 – Tuesday, August 12, 2008

Responses To My Economic Predictions

A couple of unsolicited e-mails responding to my economic predictions of last week:

“We'll done. Deequitization of a partner is really being used as a "soft landing" for non-performers. It can delay the inevitable and poison the group of performers. Also non-equity performers on the ride up the ladder get lumped with guys going down the ladder. It is a very complex issue.” Be well. Jim Hill, Chairman, Benesch Friedlander.

“I agree with you that we are in one of the most challenging economic environments in quite some time and that this will have an impact on nearly every law firm out there. We are certainly feeling it in the collections area, where clients seem less willing to pay us as fast as usual.” Best, Phil Ross, COO, Clark Hill

And from yet another reader; “Barely a quarter of our attorneys have hit their targeted billable hours so far this year. Average associate hours have fallen below 1650 and the firm is $10.5 million short of its billing goals.”

Meanwhile, Gary, my economist friend, sent me a MESMERIZING speech on the state of the U.S. economy. This was delivered by a high-level American official who is in a position to know what he is talking about. I offer no summary and no comments. Click this link. Print out the speech. Read it for yourself. Things are worse than I had imagined, and coming from the person who delivered it, we had all better take it seriously.

Post #334 – August 8, 2008

Making My Economic Predictions Known

Further to my earlier posting today (below), I am often reminded of how we are all so much a product of our history. Many years back I remember seeing a documentary entitled ‘You Are What You Were When’ which made the case for how our values and beliefs were shaped by our experiences growing up. One generation is convinced that interest rates always go up. The next is sure they always go down. One thinks credit gets easier and easier. The next knows it will never be able to borrow another dime – and doesn’t want to. One generation forgets what the generation before it just learned. Further to my earlier posting today (below), I am often reminded of how we are all so much a product of our history. Many years back I remember seeing a documentary entitled ‘You Are What You Were When’ which made the case for how our values and beliefs were shaped by our experiences growing up. One generation is convinced that interest rates always go up. The next is sure they always go down. One thinks credit gets easier and easier. The next knows it will never be able to borrow another dime – and doesn’t want to. One generation forgets what the generation before it just learned.

I remember a time, likely in the 80’s, when the economic model showed that our economy was largely based on three pillars: manufacturing, automotives and housing (ignoring for the moment Government at all levels as a huge consumer of resources) and that any kind of hick-up in any of those three could send the entire country into a Recession. Today, all three of those pillars have crumbled . . . together with the financial sector and a Government that at all levels can be clearly shown to be broke. So, I wonder to myself, what is holding this economy up?

Let’s suspend that thought for just a moment and instead turn our attention to some of the meanderings that have been emanating from legal consultants and bloggers around the country.

According to the commentary provided in a news release yesterday, entitled “A Broken Management Model” we are admonished: Cutting will likely cause a problem when (not if) the economy recovers and firms must scramble to catch up with client demand after their layoffs. "Retrain and gain" is the motto that may make most sense. Something is wrong with this picture. Applicable to all firms, irrespective of size, it makes practical business sense for law firms to treat lawyers and staff with the same care that they use in hiring them. If firms want to strengthen their performance, hiring the right person the first time for the right job will create more profits.

I read that and think, this may indeed make sense “when (not if) the economy recovers.” However, I don’t recall this consultant having the foresight, even a year ago, to be warning the profession that a slowdown was imminent, or that a credit crunch and housing meltdown would occur. I’m amused now that he thinks firms should forsake making very difficult and painful downsizing decisions today, in anticipation of an economic recovery . . . coming when?

On a similar theme a legal blogger laments: I quite clearly remember many law firms ruing their decisions to chop associates the last time an overheated economy tanked. All those associates we fired, they said, shaking their heads, if we’d held on to them, would be able to help us now. Perfectly right, of course – so please tell me precisely how long it will take and when you expect the economy will turn around, so that I can project for my partners what the losses are going to be from employing associates that have nothing to do.

It’s easy to be an armchair commentator when you’ve never had the experience of actually running a $100 million dollar professional service firm and are simply drawing upon what you think the lessons are – from the LAST time an economic slowdown happened. And what makes you think that this slowdown is going to be anything like the last one . . . we are so much a product of our history.

Meanwhile, we now read from a number of individual bloggers about how dreadful Cadwalader behaved in downsizing from 720 to 580 lawyers. We see Cadwalader being admonished for it’s obsession with productivity, profitability, and the firm's short-sightedness in having concentrated a portion of its practice on asset-backed and structured finance.

And again I say to these gifted consultants and bloggers . . . Excuse me, where was your crystal ball a year ago. I didn’t see any warnings on your blog about not focusing on specific areas of practice. Easy to take cheap shots at Cadwalader – and for what . . . for perhaps recognizing the writing on the wall sooner than most other law firms. And, so Mr. Wise Consultant and Mr. Intelligent Blogger, what is your prediction for the future?

For my part, here is MY PREDICTION:

I am usually an unrelenting optimist at heart but having closely monitored this economic scenario unfold over the last couple of years (and having periodically reported on it in this space) . . . I now fear that law firm leaders (consultants and bloggers) who have experienced only relatively good times are being 'a bit naive' in their response to signs of this impending downturn.

I submit that for the next five years, every time you think it's safe to get up and dust yourself off from this downturn, every time you feel like you've endured the worst of it, another piece of news is going to come along to freshly bludgeon you. This time the economic slowdown is going to be a lot different and, in many ways, a hell of a lot tougher. Layoffs and cost cutting will be rampant and still they won't be enough. Throw away your current strategic plan because the coming years are going to demand a whole different kind of management and leadership skill than has been required in the past.

As a start, right now – today – get on a fat-cutting mission. Do some calculations and compare your cost-per-lawyer to your competitors. Then, divide up the elements of your expense budget into two categories: those where it may pay to spend (critical skills training and productivity improvements) and those that need some careful pruning (egomaniacal advertising, staff functions that have put on weight, practice leaders nonessential pet projects, and those multiple elaborate retreats). The key is not to lose your focus and pull your horns in on everything, but to start devising a recession plan and to start reducing costs significantly.

And one year from today . . . I further predict that Cadwalader’s actions will be extolled by those same consultants and bloggers as an early example of prudent management.

Post #333 – Friday, August 8, 2008

Another Mortgage / Banking / Crisis Looming

According to a recent headline story in The National Law Journal, ‘alarmed by the dramatic rise in housing foreclosures across the nation, Judges have taken a variety of actions to slow the pace.’ Unfortunately, I think we have yet to see the dramatic force in which this mortgage meltdown is going to unfold.

Everyone has heard of subprime mortgages. The financial industry sold tens of billions of dollars of these toxic waste investments to their investors. No one knows how to recover the losses that these stupid loans have inflicted onto naive investors, which include hedge funds and European banks. And, these loans are still inflicting losses on investors.

Now in addition to subprime loans there are also Alt-A loans. These loans, a year ago, were considered to be medium-risk loans. They are the next loans up on the risk level from subprime. They are currently regarded as what would have been regarded as a subprime loan one year ago. They, too, are likely to go into default to the tune of hundreds of billions of dollars.

Then there are the ARM (adjustable rate) mortgages. These loans adjust the overall interest rate structure for relatively short-term loans. This means that the borrower does not know what he is going to be paying a year or more from now. If rates rise, his monthly payment will rise. If they fall, his mortgage payment will fall.

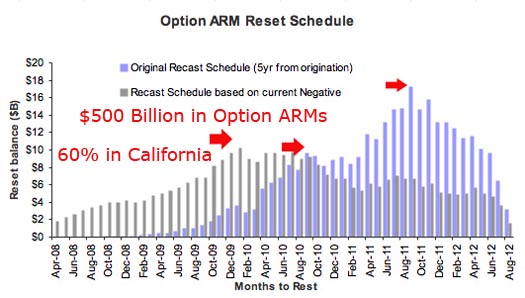

Finally, there are the least-known mortgages, called pay option mortgages. The pay option ARM mortgage allows a borrower to pay a minimum monthly payment. This minimum monthly payment is not a complete payment in order to amortize the mortgage over a specific period of time. Whatever portion of the monthly obligation that does not cover the full amortization of the mortgage is added to the principal owed by the borrower. So, if you would normally have to pay $1500 a month, but he decides to pay only $500 a month, $1000 is added to the principal owed. The person who elects to do this is never going to catch up. He has such a poor understanding of debt that he signed the papers. He put no money down. He thought he was securing his future. He was securing his eviction.

There are an estimated $500 billion of these loans, 60% in California. They are now about to come due. The mandatory trigger points for increasing monthly payments will start the default process rolling in the second half of this year (read that to mean: NOW!), as the graph on the page makes clear. The first re-sets are beginning and will escalate, month by month, until August, 2011.

This wave of unstoppable foreclosures will hit the housing market for three more years, accelerating month by month. The borrowers who took on these loans are generally ignorant people who know nothing about finances. These people are guaranteed defaulters. There is nothing Congress (or well-meaning Judges) can do about this.

So what are consumers learning from all of this?

One of the surest ways to make money in the last 10 years was to buy a house. The baby-boomers saw home ownership as equivalent to saving for retirement. Houses always went up in price; everyone knew that. If you had enough houses you didn’t need any money in the bank. A popular retirement planning technique was to buy a second house at the beach in your ’40s. And then, when you were ready to retire, you could sell the main house.

But baby boomers are realizing that houses are not the same as savings. And they’re suddenly facing up to the idea of financing their retirements in a world

of declining house prices...and rising costs. (“Home energy prices are expected to soar,” reports the New York Times.) What will they do? First, they will be forced to go back to saving. They need money for their retirements. And the only way they can get it is by reducing their spending and saving more.

However . . . the U.S. economy of the last 20 years was built on excess consumer spending. Savings rates went from around 9% of GDP down to zero. Now, if they go in the opposite direction – the drop in consumer spending will cause the worst recession since the ’30s.

And, I’m not just saying that to be provocative.

Post #332 - Wednesday, August 6, 2008

Interim Management

I received a nice note today from an old friend, currently a Firmwide Director at K&L Gates, a 1700-lawyer firm with 28 offices located on three continents.

I am about to explore a few career options. One of those options is interim management for professional service firms. With over 20 years of experience as a COO (and CFO), I believe that I can not only keep the trains running on time, but I can also make a clear difference in firm operations and revenue generation. My question is whether there is a need for this service. I understand that interim managers are part of the landscape in the UK, and also are accepted in technology arenas in the US, but I have not heard of any interim management organizations that focus on professional service firms. Are you aware of any?

As this topic is outside of my range, do any readers have any information to share with us? I would greatly appreciate your thoughts.

Page << Prev 60 61 62 63 64 65 66 67 68 69 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8