|

http://www.patrickmckenna.com/blog

Page << Prev 60 61 62 63 64 65 66 67 68 69 Next >> of 95

Post #371 – Monday, January 26, 2009

What’s On The Obama Agenda

What can one discern about the incoming Obama administration? While traveling this past week I heard from an old friend who is privy to the inner circle of Democratic politics and as you might imagine, I was particularly keen to hear what was on the agenda . . .

“Well, the first thing the new group has to do is stabilize the banking system,” he explained. “Things are still precarious with the banks. Liabilities exceed assets by a large margin. We will probably see more bank failures – small and even some large banks.”

He then got into other issues. “The housing crunch still has more rope to hang out, as well. A lot of the problem is isolated in a few states and regions of states – California, Arizona, southern Florida, the New York City metropolitan area, Massachusetts and a few other places. We are also on the cusp of a lot of failures of government entities, from localities and school districts to counties. We’re going to have a lot of municipal bond defaults. We’re going to see municipal bankruptcies. Some large states are insolvent.”

And there’s more: “The next big wave will be that consumer spending dries up. This will lead to a failure of retail businesses all over the country. It’s going to be a huge unwinding. We spent the past 25 years spending more than we could afford. Now we as a nation have to pay some big bills. It’s time to save. But it’s going to put a lot of pain into the retail sector of the economy. We’ve overbuilt retail, and everything that goes with it. Too many stores. Too many buildings. Too much inventory. Too much shipping capacity. Too many containerships unloading too much stuff made in China and elsewhere. And a lot of people are going to lose jobs. I mean a lot of people. Everywhere.”

“The next two years are going to stink for the economy. Obama will face one financial crisis after another. The coming financial issues will test the ability of the legislative branch to act with integrity in the face of a media-driven clamor. States will be lining up to borrow money from the feds just to pay unemployment compensation, let alone to fund Medicaid and road maintenance. It will test the legal system. Expect to see more cases of fraud and a lot more bankruptcy.”

“And think about the foreign policy issues. Just think in terms that when U.S. prosperity declines, it takes the world down with it. The economic contraction is going to set some societies back by decades. Will people take that lying down? Or will they riot in the streets and burn down the capitol building? Expect a rash of failed states. We’ll be surprised at some of the names that fall off the map. Wow, we might look back and wish for the days when the world hated us just because we invaded Iraq. Now they’ll blame us for stealing their future.”

What I learned was that over the next few weeks we are going to see the press focus on the wonders of this President’s First 100 Days. Enjoy the period of high hopes while it lasts. When it fades, due to the magnitude of this recession, reality will intrude.

Post #370 – Friday, January 16, 2009

Confronting A Changing Reality

Some days it seems as if the wheels are falling off the economy at home and abroad. In spite of all that gloom there are a number of opportunity-minded firms who are investing aggressively in mergers, acquisitions, talent grabs, global expansions and capital restructurings. That said, in the past few weeks I am mesmerized by some of the commentary and activity: Some days it seems as if the wheels are falling off the economy at home and abroad. In spite of all that gloom there are a number of opportunity-minded firms who are investing aggressively in mergers, acquisitions, talent grabs, global expansions and capital restructurings. That said, in the past few weeks I am mesmerized by some of the commentary and activity:

• The other day brings a news item from Citibank stating that firm managing partners report record low confidence in the economy. EXCEPT . . . Citi also informs us that “despite their dismal overall projections, managing partners remain consistently more confident about the financial prospects at their own firms, claiming they can buck the trend.” Apparently the prevailing view is that it will happen everywhere else, but not here!

• Six months ago pundits claimed the BRIC and most emerging markets would be immune from the credit crisis engulfing the United States and Europe; and every international law firm was breaking their butt to set up some little operation in Dubai. And now . . . well, everyone is asking: "Where did the Sovereign Wealth Funds go?" Today, the emerging markets have plunged more than 65% from their all-time highs, a top Kuwaiti investment bank defaulted on most of its $3 billion dollar debt obligation, and most SWFs have stopped shopping and started to repatriate their capital, as liquidity grows scarce at home.

• And NOW comes the reports of how slow things are for those US and UK law firms who have launched offices in Asia in recent months and how they are laying off associates in their Russia offices. Meanwhile, we continue to witness various law firms opening new offices - one in Frankfurt with the addition of four partners; or how about an office in Hanoi with two lawyers; then there is the east coast firm opening an office in Toronto with two lawyers; and a major firm opening an outpost in Atlanta with one lawyer (just to name a few).

Am I missing something here?

At a time when it may be imperative to protect your firm’s cash flow, be able to appropriately reward your ‘A’ players, and make prudent investments where you are going to get the highest ROI – and at a time when many firms are looking to their equity (and in some cases non-equity) partners to increase their capital position in the firm, these firms are sinking their partner’s capital into headhunter fees for lateral additions, into setting up these new offices complete with making leasehold improvements and buying equipment . . . does this make any sense? Is there a real strategy inherent in the opening of these offices . . . errrr, I mean kiosk operations?

Why would a firm be attempting to establish themselves in a new market, where they have enormous competition, little differentiation, no local name recognition, no critical mass, expenses that they don’t need right now, and the complicated internal politics sparked by these enormous upfront costs?

Is this what gets labeled as being strategic-minded, taking advantage of opportunities, and building market share during a recession . . . or this merely another example of following the herd? Unfortunately, there has been a strong tendency in this profession, for as long as I can remember, for law firm management to look around, observe what everyone else is doing, and then take a similar course of action, I guess with the assumption that there is safety in numbers.

CONSIDER: Now is the time to question every technique that worked during the boom years. The fact that prominent firms have failed in recent months should be a clear signal to rethink any ‘expand in every direction and at any cost’ philosophy. Be careful, the reality is that over this next year we are going to see a lot of red ink and some numbers that your partners will feel no safety in confronting.

Post #369 – Sunday, January 11, 2009

Leadership Reflections For 2009

Someone once said, “being a leader is being the guide on the side, not the sage on the stage.” Someone once said, “being a leader is being the guide on the side, not the sage on the stage.”

Going into a new year, here are some thoughts to reflect upon:

• Create goals that are both realistic and unrealistic; commit your goals to writing and ensure that they are measurable, and then celebrate the achievement of each goal.

• Be genuinely interested in the needs of others and be interested in the growth of others even more so than the others are at times.

• Know that all endeavors will not be easy and will not happen the way you would have planned or wished. Inspire persistence even after the first, second, and third rejection of an attempt.

• Infuse a need to grow by teaching, rather than giving the answers.

• Maintain an awareness of just how much your body communicates and remember that your body continues talking long after your lips stop moving.

• Fuss over others’ events, achievements, families, and friends.

• Avoid assuming that your communication or personality style is the one everyone else has and learn to modify your communication style to the style of others. Adhere to the principle that “communication is not what was said, but what is received.”

• Give yourself permission to leave things undone and let go of needing to be perfect, and of needing everyone else to be perfect.

• Become clear and comfortable with the fact that leadership does not mean “being the most popular one on the playground.”

• Believe that people do what they get paid attention for, and be spontaneous, as well as scheduled in your recognition efforts; but avoid giving a public person, private recognition as they will see little or no value in it.

• Remember that money does not motivate for the long term and becomes expected.

• Address only areas of behavior and performance when being critical; and avoid engaging emotions until all angles have been examined. Maintain clarity on the fact that attitudes are not taught or changed without the owner’s consent.

Exhibit leadership traits as part of who you are, not what your particular title is!

Post #368 – Sunday, January 11, 2009

The Challenges of Hourly Billing

In one of the most cogent summaries I have ever read, Fred Bartlit makes these observations today in a discussion on Legal On Ramp about where hourly billing had taken the litigation market.

First: The most discussed downside of the hourly model is, of course, that there is a big incentive to generate more hours than are needed to accomplish the task. It is axiomatic that “you get the conduct you reward” and “get the results that you measure.” So, it is inevitable that rewarding lawyers who meet hourly quotas and continually discussing hours will result in more hours being billed. Additionally, when increasing profits turns entirely on generating more hours, it is inevitable that teams will be larger than needed and more hours will be generated than needed. incentive to generate more hours than are needed to accomplish the task. It is axiomatic that “you get the conduct you reward” and “get the results that you measure.” So, it is inevitable that rewarding lawyers who meet hourly quotas and continually discussing hours will result in more hours being billed. Additionally, when increasing profits turns entirely on generating more hours, it is inevitable that teams will be larger than needed and more hours will be generated than needed.

Second: there is no incentive to work on becoming more efficient. Efficiency reduces revenue. So, it is rare to find an hourly firm spending time on innovative business processes aimed at reducing the time needed to accomplish a task or project. In contrast, in most businesses, there are huge continuing efforts to reduce time and materials inputs.

Third: there is little incentive to invest in technologies that increase efficiencies. Why? Same reason - investing in such a technology reduces revenue so that the investment is counterproductive.

Fourth: the hourly model drives a large share of the work to the least qualified workers - associates who not only have never tried a case but most likely have never seen a trial. So, not knowing what will make a difference at trial, and being driven by the need to make quotas, they spend a lot of time on projects that will never see the light of day at trial.

Fifth: the hourly model insures that the inexperienced lawyers doing the work will never become experienced. The traditional firms hire, say, 200 new associates a year. By the 8th year or so, 85% are gone and replaced by legions of other inexperienced associates. Moreover, there is no incentive to mentor or train when 85% will be gone.

Sixth: Because of the economic incentive to use large teams, many associates have little contact with the few experienced lawyers on the team. To the contrary, they deal with and are trained by senior associates and young partners who also have never tried a case.

Seventh: large teams mean that the key knowledge is widely dissipated so there is a big risk that the person on her feet at trial will not personally know the whole picture.

Eighth: All of this is a recipe for low morale and esprit. Working on projects that never see the light of day and being graded primarily on time expended rather than creativity, leadership and efficiency is a sure morale buster. As is the lack of contact with leaders and lack of mentoring, motivation. Low morale people do low quality work.

Ninth: an adversarial relationship often emerges between lawyer and client. We have heard recommendations from “billing partners” to “not take write-offs before the bill goes to the client because the client will insist on and get write-offs and we do not want to take write offs twice” This is, of course, an admission that most bills are too high and will be reduced. Additionally, there has grown up a cottage industry of “catching lawyers padding bills” in which outsiders are hired to check all aspects of bills. These “auditors’ would not exist if it were not known that bills are routinely overstated

Tenth: the law firms profits are driven by hours, not be quality/efficiency or results. When results are to some extent irrelevant to profits (except in the very long term) Econ 101 says that focus will be on “process and projects” rather than on quality/winning.

Eleventh: Efforts to suggest or foster innovation are often derided as “you do not get it. This is complicated stuff and cannot be predicted or projected”

Twelfth: Corporate managers are irked because every part of a corporation budgets and predicts but litigation costs cannot be predicted.

Now: I do not mean to imply that the leaders of the great traditional firms are venal. To the contrary, they are among the smartest people in the US, care deeply about their firms and their clients, are honest, ethical and want to do the right thing.

The problem is that the market is trapped by a business model that once was useful but has been taken to extremes that have generated the problems referred to above.

While many have predicted the demise of the billable hour for too many years for me to remember, this sobering look at an outdated business model may be just the thing that corporate counsel will spend more time doing as they are continually squeezed in 2009 to reduce their budgets.

Post #367 – Sunday, January 11, 2009

Succession Experiences

In response to my rant (#365) of a couple of weeks back concerning the transition period for new leaders, I received a nice note from Edwin Reeser confirming his own experience that is worth sharing:

I had a five month period of apprenticeship / transition to become the managing partner of a 70 attorney office of a 600 attorney national firm. It was probably about six weeks to two months more than I needed, but nevertheless every day was used. I had a five month period of apprenticeship / transition to become the managing partner of a 70 attorney office of a 600 attorney national firm. It was probably about six weeks to two months more than I needed, but nevertheless every day was used.

The dynamic is different for every situation of course. In my office, the transition was required by the charter of the firm, and I replaced a managing partner who had been at the helm of the office for 17 years. So a lot of time had to be spent sensitively dealing not only with all of the new responsibilities and people, but the outgoing chief who was a very successful partner with a solid book of business.

Apart from learning all the mechanics of how to run an office like that, and there are many, there is something else that is critically important to recognize about a law firm, and that is it is first and foremost a people business. And you need some time to reach out and forge new and different relationships with all of your partners, and key staff people, and you have to steadfastly and continuously build on them. And you have to try to do the same with your associates as best you can.

You also have to establish your own style and identity of dealing with people and problems. And as the managing partner, you are in a law firm the only fire hydrant outside the Westminster Kennel Club Dog Show.

And you become the repository of information that can never be shared, with anyone, ever. Some of it is uplifting and courageous and reaffirming of all that is good with mankind. Some of it so dark and depressing that tears scar into your soul. All of it is about people. And you carry it with you forever.

Somewhere along the way the difference between "managing" and "leading" gets feathered out and recognized by everyone around. If you cannot do the latter you will not be long at the former.

But to just dump somebody in to the role and follow the "sink or swim" approach in a law firm. It would be more merciful to just shoot the sorry person or push her/him off a cliff. A responsible and open and visible transition with strong mutual support by the incoming and outgoing persons, showing collaboration and joint roles in major decisions is essential. I routinely would send a "sonar ping" of opinion soliciting to my predecessor months, and years after the transition. Firstly, because he had so much experience and I always was open to learning how he did, or would have done, the same or related tasks. Secondly, he was a partner and I would solicit input from many of my partners on various items. (Because, the group intellect is always better than one intellect, and getting a better idea from somebody else is superior to only tapping your own best idea. If only by the process employed it gives confidence in the ultimate outcome, and you often need that.) That all takes time to demonstrate and have accepted if you are going to be effective and supported by your partners. And they are the interests that the managing partner should SERVE and clearly put before him / her self.

Thanks Edwin. Well stated.

Post #366 – Thursday, January 8, 2009

Facing The Music

I’m more than a little surprised to see that there has been no attention paid in the legal blogs or in other articles to a piece written by Nate Raymond (American Lawyer) last week reporting on how law firms owe more, are paying later, and are submitting to more intrusive reporting requirements from their banks.

According to Nate, firms are going deeper into their credit lines, firms are taking much longer to pay those lines down . . . and thus banks are now demanding more financial information from firms and wanting more frequent updates (read that to mean monthly, rather than quarterly or semi-annually). Banks are also asking for a monthly report on partner comings and goings. Gee, I wonder why? According to Nate, firms are going deeper into their credit lines, firms are taking much longer to pay those lines down . . . and thus banks are now demanding more financial information from firms and wanting more frequent updates (read that to mean monthly, rather than quarterly or semi-annually). Banks are also asking for a monthly report on partner comings and goings. Gee, I wonder why?

At the beginning of this decade, one of the (many) causes of Brobeck’s downfall was the reluctance of firm management to make the necessary cuts to survive and I see that same scenario playing out once again for many firms. This past weekend I was reading the comments from a transcript discussing what firms should and shouldn't do to ride out the economic storm. So as not to unduly embarrass anyone I will not identify either the article or the participants, but suffice to say I was shocked by a few of the comments coming out of a group from whom I would have expected more innovative thinking. For example, this comment from a former AmLaw 200 managing partner: “It is not the time to freeze billing rates . . . You just can't afford to do that because you can't catch up. If you go for a year or two with frozen billing rates and then try to catch up, you have to jump them by 10 per cent or something, and you're going to have huge client pushback.” And this one from a supposed consultant who should know better: “I'm against cutting the under-performers unless you really have to. Sure, sometimes there is no choice. But shame on the leader who has left it until now: You're now releasing people into a far more dangerous environment and you're hurting them a lot more.”

Meanwhile, the dissolutions of Heller and Thelen can be attributed to heavy debt commitments. The most interesting part of Nate Raymond’s story was the commentary provided by a Gibson Dunn attorney who handled the dissolutions of all of the above mentioned firms (plus: Coudert Brothers and Jenkens & Gilchrist). THIS is worth burning into our memory banks: “The situation in all of them is remarkably similar. A firm takes on loads of debt for rapid expansion. Something happens to affect the firm’s revenue. Less money exists to pay down the debt and firms cut distributions. That in turn encourages partners to flee for more money. Repeat the cycle.”

Of course the alternative to borrowing is to demand more capital from partners, and so that is precisely what Clifford Chance is doing. They have now asked partners to make a cash contribution of up to £100,000 to the business. Each member of the firm’s global partnership will now make the capital contribution in a move the firm described as a “normal part of managing its finances.”

Meanwhile, according to a new survey of financial professionals from 17 different industries, 86% had replanned or reforcast their last quarter, with nearly half doing so two or more times. Going into 2009, many Fortune 1000 companies will have set for themselves three budget scenarios - best case, most realistic and worst case scenarios and have now set their budgets based on the mid-level realistic scenario (which likely calls for some significant cuts, even in the Legal Department). Upon seeing the revenue results from the first quarter of 2009, I predict that these companies will then quickly revert to their worst-case scenario budget projections and be demanding quick action from all departments and subsidiaries.

The pressure for change will then become even more intense.

Post #365 - Tuesday, December 30, 2008

Rules of Succession Revisited

In an article in The Recorder, written earlier this month entitled Rules of Succession, Hildebrandt consultant Carl Leonard claims that when a new law firm leader is chosen, it's better to hand over the reins immediately. In an article in The Recorder, written earlier this month entitled Rules of Succession, Hildebrandt consultant Carl Leonard claims that when a new law firm leader is chosen, it's better to hand over the reins immediately.

I don’t usually take issue with the advice offered by other consultants, especially one who has served for 10-years as Chairman of a distinguished AmLaw firm, but this is one of those times where someone’s views may not only be unfortunately biased by their own personal experience, but actually hazardous to the personal aspirations and career progress of new law firm leaders.

According to Leonard, in 1993 following his announced intention to step down he thought he was doing his firm and his successor a favor by allowing a four-month transition of leadership. He explains, “I could not have been more wrong. The firm drifted. A leadership vacuum ensued. I had the power of the office but, being a lame duck, no one paid any attention to me.”

Leonard goes on to counsel new leaders that “Since that time, I have preached on innumerable occasions — managing partner workshops, law firm leadership forums, graduate school programs on law firm management — that law firms should not follow the U.S. approach to transitions in leadership. Elect your new managing partner or chair and get on with it — immediately!”

Now I’ve had the good fortune to author two monographs: First 100 Days for new managing partners; and Passing The Baton for those about to relinquish office. Both of these texts benefited enormously from the input of dozens of managing partners from firms of all sizes who provided their real-world perspectives and experiences. In addition I’ve conducted research and one-on-one interviews with at least 50 law firm leaders covering all aspects of their jobs, the challenges attached to leading a law firm, and the agony of making the difficult transition to becoming a firm leader. All of my work unhesitatingly confirms for me that the problems that Carl Leonard refers to (firm drift, leadership vacuum, and the lame duck syndrome) may indeed occur, but are usually the result of not knowing how to conduct an effective transition from one leader to the next.

I know from first-hand experience in facilitating candid, in-depth discussions between the outgoing and incoming firm leaders, that the outgoing leader can provide unique insights on everything from the expectations of certain power partners to the idiosyncratic attitudes of various board members. No one is in a better position to get a new leader up to speed than his or her predecessor. The accumulated wisdom of the incumbent is incredibly valuable during the transition period and appears to have simply evaporated in Carl Leonard’s described transition process.

Outgoing firm leaders play an important role in building the foundation upon which their successor can begin their tenure. For example:

• A leadership transition is a good time for the incumbent to deal with those long delayed but annoying operational problems or troublesome personalities, so the new leader can come in and immediately begin to address the more important and strategic issues.

• Securing early wins to build momentum is important. As the outgoing leader, you can help your successor identify areas that offer the best opportunity for quick success and highlight potential pitfalls or areas of partner contention.

• I’ve counseled those retiring from the position to “think about what information you would want at close proximity, if you were now about to embark on accepting this leadership position. You owe it to the next leader to provide detailed information about critical tasks and deadlines. And, your potential for being of immeasurable assistance goes well beyond just administrative minutia.”

Contrary to Leonard’s advice to “get on with it – immediately,” what I’ve learned is that this transition (News Flash!) is not about you as the outgoing leader. Your primary role in the final days is not to become obsessed with how your colleagues see you or what you think your legacy is going to be; your primary role is to help your successor succeed. I would enthusiastically advise new firm leaders that a transition period of a couple of months is absolutely necessary and allows for you to attend to all of the myriad of details that need to be thought through before assuming office.

There are numerous activities that need your attention during the period from when you are first elected (or selected) to your first official day in office – from preparing your family for the huge time sacrifice that is about to transpire, to determining how you are going to transition some (or most) of your personal practice and the inherent client relationships.

One of the primary issues in becoming a firm leader is in getting to really know your strengths and weaknesses (some pertinent self-discovery). At the First 100 Days master class that Brian Burke and I have now conducted with over 40 leaders from firms between 75 and 1800 lawyers in size we put every registrant through a personal assessment instrument to help them better understand their unique strengths and how they react under stress. Ideally, these new managing partners want to receive this kind of instruction ‘before’ they assume office, not after they’ve been dropped into a quick sink-or-swim situation. During the course of a day, we methodically go through answering the kinds of questions that new firms leaders are often most concerned about:

• Am I really clear on the reasons why I accepted this position?

• How can I be sure that I have correctly understood what is expected of me?

• Which tasks should be a priority and which can be put on hold?

• Who am I going to meet with first and what am I going to say?

• Have I defined the challenges facing my firm and determined an approach to dealing with them?

• When can I begin to introduce change and what is my initial plan of action?

• How do I make sure that I have the support I need from the partnership?

There is no definitive answer to the question of exactly how long an outgoing leader should stay in office after announcing his or her departure. The consensus among those firm leaders that I have discussed this with, is that three months is about the maximum an outgoing leader should remain at the helm. Meanwhile, some research undertaken by Burson-Marsteller (a leading global PR firm) tells us that the “countdown period” for the transition of an ‘internal’ CEO - the amount of time between the announcement of a newly promoted CEO and the date the executive officially takes office is 64 days.

Post #364 – Monday, December 22, 2008

Merry Christmas

New York, N.Y., is the city so nice that named it twice . . . but its reputation didn’t keep Santa from getting a parking ticket while delivering toys. St. Nick says that he will fight the ticket, reported the New York Daily News while I was there. According to the report, the jolly old guy was riding in a horse-drawn carriage as he handed out toys, while an SUV carrying his bounty and protecting his horse from traffic was double-parked behind him. Santa says he yelled, “Ho, ho, ho,” to get the meter maid’s attention but, alas, it didn’t work. “This grinch just went ahead and fined me!”

Meanwhile in London, a Santa at Selfridge’s department store was fined for asking a female shopper if she wanted to sit on his lap. “It’s disappointing, but I’ve learned that even as Santa Clause, you can’t please everyone all of the time,” this not-so-jolly elf told The Guardian.

And finally, this is news that bears repeating. According to USA Today, a poll revealed that 95 per cent of respondents are not offended by the greeting “Merry Christmas.” However, 46 per cent are offended by the phrase “Happy Holidays,” which is often extended by someone who is concerned that saying “Merry Christmas” might be offensive.

So, here is to a Very Merry Christmas.

A Christmas Poem A Christmas Poem

I have a list of folks I know, all noted in a book; and every year at Christmas time, I go and take a look.

That is when I realize, that these names are but a small part, not of the book they’re written in, but of my grateful heart.

Every name stands for someone, whose path touched mine and then, left a special imprint and memory, that I yearn to touch again.

While it sounds fantastic for me, to even admit such a claim, I really feel I am truly blessed, by each remembered name.

And every year when Christmas comes, I realize anew, the greatest gift that life can give is meeting folks like you.

So may the spirit of Christmas, that forever and ever endures, leave its many blessings, in the hearts of you and yours.

Post #363 – Monday, December 15, 2008

The Second Mortgage Disaster

Déjà vu. Last night on CBS, the news program 60 Minutes covered what they called, ‘The Second Mortgage Disaster on the Horizon’. Déjà vu. Last night on CBS, the news program 60 Minutes covered what they called, ‘The Second Mortgage Disaster on the Horizon’.

It looks like the mainstream news media is finally picking up on something I blogged about here over four months ago: Alt-A and option ARMs. For those who are new to the game, Alt-A and option ARMs are two other types of exotic mortgages that have been lurking in the background, while the rest of the country worries about subprime alone. Although these loans were made to people with higher quality credit, these types of loans, specifically the option ARMs, still lured borrowers in with ‘low teaser rates.’ The problem with these rates, however, is right in the description, they are just a ‘teaser’. Eventually, they reset. And a mortgage that was $800, can shoot up to $1,500 . . . and many homeowners are ill-equipped to deal with this. In fact, one out of every ten homeowners in the United States right now is behind in their mortgage payment.

Back on August 8th (Post #333), I warned:

Unfortunately, I think we have yet to see the dramatic force in which this mortgage meltdown is going to unfold. Everyone has heard of subprime mortgages. Now in addition to subprime loans there are also Alt-A loans. These loans, a year ago, were considered to be medium-risk loans. They are the next loans up on the risk level from subprime. They are currently regarded as what would have been regarded as a subprime loan one year ago. They, too, are likely to go into default to the tune of hundreds of billions of dollars.

Then there are the ARM (adjustable rate) mortgages. These loans adjust the overall interest rate structure for relatively short-term loans. This means that the borrower does not know what he is going to be paying a year or more from now. If rates rise, his monthly payment will rise. If they fall, his mortgage payment will fall.

Finally, there are the least-known mortgages, called pay option mortgages. The pay option ARM mortgage allows a borrower to pay a minimum monthly payment. This minimum monthly payment is not a complete payment in order to amortize the mortgage over a specific period of time. Whatever portion of the monthly obligation that does not cover the full amortization of the mortgage is added to the principal owed by the borrower. So, if you would normally have to pay $1500 a month, but he decides to pay only $500 a month, $1000 is added to the principal owed. The person who elects to do this is never going to catch up. He has such a poor understanding of debt that he signed the papers. He put no money down. He thought he was securing his future. He was securing his eviction. Finally, there are the least-known mortgages, called pay option mortgages. The pay option ARM mortgage allows a borrower to pay a minimum monthly payment. This minimum monthly payment is not a complete payment in order to amortize the mortgage over a specific period of time. Whatever portion of the monthly obligation that does not cover the full amortization of the mortgage is added to the principal owed by the borrower. So, if you would normally have to pay $1500 a month, but he decides to pay only $500 a month, $1000 is added to the principal owed. The person who elects to do this is never going to catch up. He has such a poor understanding of debt that he signed the papers. He put no money down. He thought he was securing his future. He was securing his eviction.

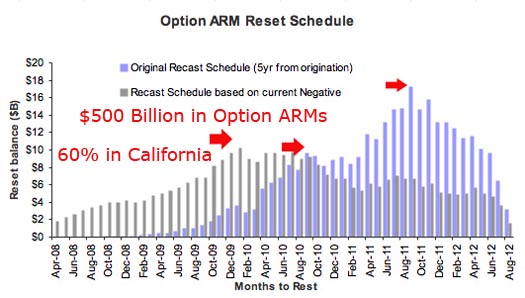

There are an estimated $500 billion of these loans, 60% in California. They are now about to come due. The mandatory trigger points for increasing monthly payments will start the default process rolling in the second half of 2008 as the graph here makes clear. The first re-sets are beginning and will escalate, month by month, until August, 2011.

This wave of unstoppable foreclosures will hit the housing market for three more years, accelerating month by month. The borrowers who took on these loans are generally ignorant people who know nothing about finances. These people are guaranteed defaulters. There is nothing Congress can do about this.

Post #362 - Wednesday, December 10, 2008

Fortune 500 Procurement Initiatives

With growing budgetary pressures, more Fortune 500 legal departments are beginning to take aggressive steps to explore more cost-effective delivery options. Imagine unexpectedly receiving a large package of materials from one of your signature (top ten revenue-producing) clients. The package contains a number of documents explaining this company’s serious new procurement initiative. Start with a cover letter and 9-page Guidebook for filling in the accompanying Questionnaire. Here are a few brief excerpts from the instructions: With growing budgetary pressures, more Fortune 500 legal departments are beginning to take aggressive steps to explore more cost-effective delivery options. Imagine unexpectedly receiving a large package of materials from one of your signature (top ten revenue-producing) clients. The package contains a number of documents explaining this company’s serious new procurement initiative. Start with a cover letter and 9-page Guidebook for filling in the accompanying Questionnaire. Here are a few brief excerpts from the instructions:

As part of our continued focus on improving overall operations, we have undertaken an initiative that focuses on minimizing the total cost of purchased services while improving quality, delivery and service. Specifically, we will introduce new purchasing methodologies, implement a skilled and centralized procurement organization and develop enhanced systems and tools that will allow us to strategically source and procure while leveraging our enterprise-wide spend.

Please ensure that your responses to the questionnaire are accurate and complete. The primary objectives of this questionnaire include:

• Identifying preferred outside counsel who can meet or exceed our legal services business requirements

• Seeking opportunities to streamline legal services management processes

• Reducing total cost of legal services

• Identifying and implementing law firm best practices

AND of course:

All time and expenses or other charges incurred by the responder for participation in this questionnaire process and gathering required information, including document preparation, communications, demonstrations, or possible site visits are entirely the responsibility of the responder and will not be borne by (the company).

Now, here are but a few of the dozens of questions that you are required to answer:

• Has your firm had any attorneys who have worked on our matters or who are currently working on our matters who have left your firm? If so, where did they go?

• Who are your three main competitors?

• How does your firm's business differentiate from these competitors?

• Describe the best practice processes that are currently being used by your firm…

• Describe your formal continuous service improvement process?

• What metrics does your firm collect to manage service levels provided to its clients?

• Does your firm engage in surveys, score-carding, periodic reviews, etc to ensure client satisfaction? If so, describe your engagement in these activities with other clients and provide samples …

• In what cost containment models with clients has your firm participated? For each, please describe its success, appropriate application, and pros & cons?

• Please fully describe your efficient, effective, and creative cost saving and spend reduction ideas?

THE LESSON: As you might imagine, completing this questionnaire requires an enormous investment of  non-billable professional time compiling financial records, practice area descriptions, lawyer biographies, billing rates, matter specifics, and then identifying firm capabilities, proposing value-added partnering activities and answering specific questions (like the brief sample above). Fortunately, my client firm had, months earlier, taken the decision to invest considerable time to develop a formal client team, meet with their various client representatives, and proactively propose a plan of value-added and cost-reduction activities. One wonders how those firms who unexpectedly have to respond to this kind of procurement initiative, are going to fare. Be warned. Your questionnaire is coming. non-billable professional time compiling financial records, practice area descriptions, lawyer biographies, billing rates, matter specifics, and then identifying firm capabilities, proposing value-added partnering activities and answering specific questions (like the brief sample above). Fortunately, my client firm had, months earlier, taken the decision to invest considerable time to develop a formal client team, meet with their various client representatives, and proactively propose a plan of value-added and cost-reduction activities. One wonders how those firms who unexpectedly have to respond to this kind of procurement initiative, are going to fare. Be warned. Your questionnaire is coming.

Page << Prev 60 61 62 63 64 65 66 67 68 69 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8