|

http://www.patrickmckenna.com/blog

Page << Prev 70 71 72 73 74 75 76 77 78 79 Next >> of 95

Post # 192 - Tuesday, May 1, 2007

Creating Better Practice Group Leaders

Whenever I ask partners about the activities, the behavior and about the overall effectiveness of their particular practice group leader, I unfortunately confirm that only about one in ten are considered capable. Far too many practice groups are burdened with having leaders only focused on their own practice, rather than on helping their groups succeed. Whenever I ask partners about the activities, the behavior and about the overall effectiveness of their particular practice group leader, I unfortunately confirm that only about one in ten are considered capable. Far too many practice groups are burdened with having leaders only focused on their own practice, rather than on helping their groups succeed.

The decision about who becomes a practice group leader is one of the most important that any managing partner can make if he or she expects to influence the firm’s long-term profitability and success. Following proper selection, managing partners must also assist their practice leaders to become more effective by giving them the tools they need. Here is one of the tools worth considering.

I am delighted to be Chairing the Managing Partner Magazine’s Second Annual Practice Group Leadership Forum. This two-day event, being held in Chicago on May 23rd and 24th, will feature prominent speakers from Baker & Daniels; Jenner & Block; Hinshaw & Culbertson; Holland & Hart; Ice Miller; Loeb & Loeb; Powell Goldstein; Reed Smith; and others. Your copy of the agenda may be obtained here.

Post #191 - Monday, April 30, 2007

How to Lose Clients

We should all heed the advice offered by John Doerr, founder of Wellesley Hills Group, on what attributes to avoid, unless you want to lose your clients.

• Once you sign the deal, disappear.

• Show a consistent lack of respect for your client inside your own firm.

• Hide the other ways you can help – hey, it's "my" client.

• Keep to the tried and true approaches.

• Don't ever, ever check to see how you are doing.

• Make your invoices as confusing and indecipherable as possible.

Post #190 - Sunday, April 29, 2007

Presentation Tips

I received this e-mail from my buddy Joe Murphy the other day: "I was in a presentation earlier this week that was - in a word - awful. The material was excellent. The presenter was dreadful. He was not animated, droned on, and missed an opportunity to make key points. I couldn't help but remember this link and the lessons outlined that we can all stand to review before any meeting of importance." I received this e-mail from my buddy Joe Murphy the other day: "I was in a presentation earlier this week that was - in a word - awful. The material was excellent. The presenter was dreadful. He was not animated, droned on, and missed an opportunity to make key points. I couldn't help but remember this link and the lessons outlined that we can all stand to review before any meeting of importance."

The author of these 11 slides provides some good ideas around gestures, eye contact and body language that can be used in meetings and presentations. This is a great reminder of how to become more effective and more successful in our work.

Post #189 - Sunday, April 29, 2007

Management Tools

The biannual Bain & Company's Management Tools and Trends 2007 survey is out. This survey asks executives around the world to assess their usage of and satisfaction with particular management tools, such as benchmarking, mission and value statements, strategic planning, mergers and acquisitions, and about twenty others.

Bain & Company launched this multiyear research project in 1993 to gather facts about the use and performance of these management tools. Bain has now completed 11 surveys, assembling a database that includes 8,504 respondents from more than 70 countries in North America, Europe, Asia, Africa, the Middle East and Latin America. This year, they received 1,221 completed surveys from a broad range of international executives and focused on 25 of the most popular tools and techniques.

The tools are mostly tried-and-true management ideas, but the survey provides an opportunity to check on how particular ideas are faring. The results are always interesting.

Post #188 - Wednesday, April 18, 2007

Are You Differentiated?

There is an interesting article in the current (April) issue of Of Counsel: The Legal Practice and Management Report. The inimitable Steve Taylor has once again donned his Investigative Reporter’s cap to discern whether law firm consultants differentiate themselves in any meaningful way for their clients.

Among the six firms he reviewed Edge International was cited as having “a stellar reputation as the go-to consultancy for practice group management and training”; as “one of the few to offer a satisfaction guarantee” and for performing in accordance with their ‘reputation before revenue’ philosophy. In addition, Edge was recognized “as a firm that gets its message out in print very well and very prolifically.” the go-to consultancy for practice group management and training”; as “one of the few to offer a satisfaction guarantee” and for performing in accordance with their ‘reputation before revenue’ philosophy. In addition, Edge was recognized “as a firm that gets its message out in print very well and very prolifically.”

Steve's overall conclusion: “When asked to differentiate themselves from their competitors, consultants seemed able to do so much more effectively then their clients" . . . differentiation articulated by some of the same people who invented the concept.

Post #187 - Monday, April 16, 2007

Leaders Who Matter

We issued the following press release today concerning the results of our latest survey:

Survey by Leading Legal Consulting Firm Names Most Admired Law Firm Leaders

Respondents Cite Ambition, Longevity as Qualities of Exceptional Managing Partners

Edge International, an international legal consulting firm, has released a survey in which top law firm managing partners identify their most admired peers. Edge International, an international legal consulting firm, has released a survey in which top law firm managing partners identify their most admired peers.

According to Michael Anderson, an Edge Partner, over 60 law firm managing partners responded to the Edge survey, which asked them to identify which law firm leaders, from firms other than their own, they admired the most for their management and leadership competence. They were also asked what qualities made their selections admirable.

The survey concluded that Robert M. Dell, chairman and managing partner of the law firm Latham & Watkins LLP, is the most admired law firm leader, receiving 13% of the respondents’ total votes.

Regina M. Pisa, chair and managing partner of the law firm Goodwin Proctor LLP and Lee I. Miller, Firm joint chief executive officer of DLA Piper US LLP, tied for second place for respondent votes in the poll. Other firm leaders who rounded out the top ten most admired law firm leaders include: Ben F. Johnson III, of Alston & Bird LLP; Cesar L. Alvarez, of Greenberg Traurig, LLP; Bob Odle, of Hogan & Hartson LLP; Patrick McCartan of Jones Day; Ralph H. Baxter, Jr., of Orrick and Herrington & Sutcliffe LLP; T. Kennedy Helm III of Stites & Harbision, PLLC; and Keith W. Vaughan of Womble Carlyle Sandridge & Rice LLP.

It is notable that Odle and McCartan were selected by those surveyed, as both have retired from their respective firms.

When asked what leadership and management qualities made their selection admirable, the most common responses included: a willingness to make change, promote ambitious agendas, the ability to handle tough issues and get people within the firm aligned, and a commitment to maintaining the core values of the firm.

“One of the interesting developments,” explained Patrick McKenna, the Edge Partner who initiated the survey, “was that we heard from another dozen or so firm leaders, who took the time to send us e-mails apologizing that ‘they were not familiar with other managing partners’ or ‘didn’t know enough to identify anyone specific.’ I guess our profession is not yet rife with numerous well-recognized management role models, but this survey shows that we’re evolving.”

Post #186 - Monday, April 16, 2007

New Corporate Counsel Magazine

I'm delighted to have been asked to author a regular column for a brand new Corporate Counsel magazine that just premiered. Have a look at the e-magazine version.

My article, co-authored with Derek Patterson, General Counsel and Corporate Secretary for the Insurance Corporation of British Columbia, is entitled: The Metrics System: How to create your legal department's performance metrics - a challenge for many in-house legal department General Counsel.

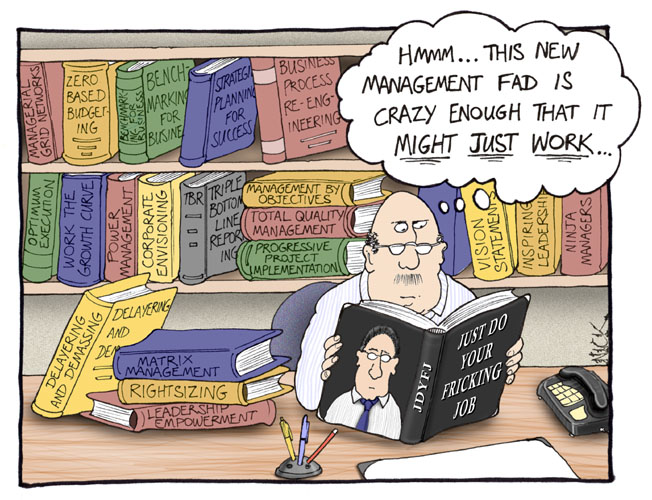

Post #185 - Thursday, April 5, 2007

Summary Of Management Theory

[Hat tip to Businesspundit]

Post #184 - Tuesday, April 3, 2007

Law Firms Going Public

Still on our topic of things getting interesting . . .

lawyers at Australian national law firm Slater & Gordon are set to pocket millions of dollars from a public offering of their practice. The firm's 41 equity holders are expected to raise tens of millions of dollars from a float that is in the final stages and thereby becomes the world's first full-service law firm to float on a stock exchange. & Gordon are set to pocket millions of dollars from a public offering of their practice. The firm's 41 equity holders are expected to raise tens of millions of dollars from a float that is in the final stages and thereby becomes the world's first full-service law firm to float on a stock exchange.

The firm issued its prospectus yesterday with an offer period scheduled to run from 11 April to 27 April, and hoping to raise around A$35m. According to The Lawyer, the appetite for shares in Slater & Gordon is insatiable. With more than a week to go before Australian law firm makes its stock exchange debut, around two-thirds of the shares have already been locked up via irrevocable letters of intent from around 40 institutions.

Apparently Slater & Gordon are leaders in Australian asbestos law, specializing in claims for asbestos injury and related diseases including asbestosis, mesothelioma, lung cancer and pleural plaques. Sources say the firm is planning to use the money from their public offering to take over legal practices that have had difficulty adapting to changes in the increasingly complicated area of workers compensation and personal injury law. Slater & Gordon also hopes to expand into new areas of practice. Another attraction of a public listing for Slater & Gordon is that it currently uses debt to finance a substantial proportion of its work in progress, which is standard practice for law firms that offer no-win, no-fee agreements.

Half of the money raised from the float is set to be allocated to seven shareholders, who will own 48.8 per cent of the new company after the IPO. This precedent-setting deal follows a change in the law in Australia that allows local lawyers to raise funds and allows non-lawyer investors – a move similar to the UK's Legal Services Act.

Post #183 - Tuesday, April 3, 2007

Did You Know?

Reacting to my March 29 post, “The Intractability of The Situation, one reader sent me this interesting e-mail today:

This March 29th headline belonged on the front page of every daily newspaper:

Iran, the world's fourth largest oil producer, will stop pricing oil in U.S. dollars, with less than half of its oil income now paid in the American currency, Iran's central bank governor said. Iran, the world's fourth largest oil producer, will stop pricing oil in U.S. dollars, with less than half of its oil income now paid in the American currency, Iran's central bank governor said.

But, you probably missed it. That's because you don't read Al-Jazeera, the Arabic newspaper. The only mainstream media outlet that bothered to run this story was The International Herald Tribune, which is owned by the New York Times.

The fact that Iran is openly calling on oil buyers to settle their accounts in currencies other than the United States dollar is reminiscent of Saddam Hussein's similar decision in September, 2000. Oil was then around $30. The euro was introduced in 1999 at an exchange rate of $1.17. It started falling almost immediately. It bottomed in October, 2000, a few days after Hussein's announcement, at 83 cents. It stayed low until October 2001, after the 9-11 attack, when it started rising. So, initially, Hussein's announcement did not have any visible economic effect on the dollar / euro exchange rate. A month before the Iraq war began, the euro was around $1.10. It continued to rise after the war began in March, 2003.

The U.S. dollar is the world's reserve currency. About 65% of all central bank foreign exchange reserves are held in the dollar. With Iran now selling oil only for other currencies, it has offered a challenge to the other OPEC exporters. They can get out of the petrodollar trap by switching to the euro. Iran is about to set the precedent. Iraq did, but it was invaded. Then the old arrangement was re-imposed by the Americans: oil for dollars only.

By telling other oil exporters that it's a good idea to do business in other currencies, Iran threatens to cause a shift in central bank holdings. If the euro continues to rise, central banks are better off by buying euros. At the margin, they will make money. But the dollar will fall: reduced demand for dollars. The downside of this is two-fold: (1) a falling dollar means fewer exports to America; (2) a falling market price of their existing holdings of T-bills. This will hurt Japan and China the most.

This threat to U.S. foreign policy is great. The threat to the domestic economy is worse. The dollar has been subsidized by OPEC nations for 35 years. The dollar's looming fall in value in relation to other currencies is a minimal threat to the American economy compared to rising oil prices. We are importers of oil. If gasoline prices rise, voters will seek vengeance. Republicans know this. So, Iran is now a threat to Bush and the Republicans in 2008.

Things are about to get interesting indeed!

Page << Prev 70 71 72 73 74 75 76 77 78 79 Next >> of 95

|

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8