http://www.patrickmckenna.com/blog

Page << Prev 20 21 22 23 24 25 26 27 28 29 Next >> of 95

Rant #702 – Tuesday, May 13,

2014

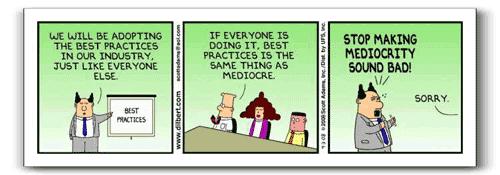

Best Practices Aren’t Always

Best

I was taken back the other day by an article wherein

the author, a law firm consultant, was promoting the concept of best practices. His proposition was that “the attaining of best practice can lead to a

competitive advantage in which true excellence becomes a winning competitive

formula.” It all sounded so compelling. He then suggested that professional

service firms should engage (obviously with this particular consultant) in a 'best

practice make-over' to concentrate on getting your firm to an improved

operational state. Doing a bit of research, I discovered that this idea

probably had its origins in a book entitled, “How to renovate your business:

the information best practice makeover that really works.” So get ready for

it. Here comes the newest consulting trend, best practice makeovers! I was taken back the other day by an article wherein

the author, a law firm consultant, was promoting the concept of best practices. His proposition was that “the attaining of best practice can lead to a

competitive advantage in which true excellence becomes a winning competitive

formula.” It all sounded so compelling. He then suggested that professional

service firms should engage (obviously with this particular consultant) in a 'best

practice make-over' to concentrate on getting your firm to an improved

operational state. Doing a bit of research, I discovered that this idea

probably had its origins in a book entitled, “How to renovate your business:

the information best practice makeover that really works.” So get ready for

it. Here comes the newest consulting trend, best practice makeovers!

These days you hear a lot about the quest for best

practices in all areas. I have a biased view in that I think “best practices”

is one of today’s most overused terms. Anyone discussing what needs to be done

to improve some given situation will often use the term, as though to justify

the safety in taking action. So, what is it about the term, ‘best practices’

that makes it sound so persuasive, and yet why don’t they always seem to work

as well as some are suggesting?

I’ve had a few questions come to mind over the years that I

believe are worth considering . . .

Read my entire article as posted on LinkedIn.

Post #701 – Tuesday,

April 15, 2014

The Spring

2014 Issue of International Review is Now Available

International Review is my 24-page glossy, printed magazine

distributed to over 1600 law firm chairs and managing partners throughout North

America. The articles in this issue

include The Seeds of Competitive

Disruption which

identifies 20 different US-based competitors that are growing and that your

partners should be aware of. Part of the

job of every firm leader is to neutralize complacency and so I’m hoping that

this article might be worth you passing around. International Review is my 24-page glossy, printed magazine

distributed to over 1600 law firm chairs and managing partners throughout North

America. The articles in this issue

include The Seeds of Competitive

Disruption which

identifies 20 different US-based competitors that are growing and that your

partners should be aware of. Part of the

job of every firm leader is to neutralize complacency and so I’m hoping that

this article might be worth you passing around.

In our First 100 Days program (see:

first100daysmasterclass.com) we

introduce new firm leaders to the monumental task of taking the reins of

leading their firms. Firm

Leadership Is Not For Wimps! is an attempt to identify eight of the

more challenging truths to being an effective firm leader, and I’m grateful to

those who have provided valuable input into this piece (you know who you are –

and thank you).

Finally, Six

Factors That Can impede Effective Firm Leader-COO Relationships had it’s origins in a Webinar that I was

privileged to conduct with John Michalik, retired executive director of the

international Association of Legal Administrators; while A Novel Approach To Compensation

grew out of an innovative ThinkTank event that I participated in earlier this

year, and Are You Getting The Minutes From Practice Group Meetings? is a

prescriptive article for every firm leader who has an interest in knowing what

their practice groups are really doing.

As always, I sincerely hope that you find some practical

ideas, tips and techniques here that you can put to use immediately.

Please send me your observations, critiques, comments and suggestions with

respect to any of these articles.

Click on the Cover to download your complimentary PDF

copy of the magazine.

Post #700 – Wednesday, April

9, 2014

Best Practices For Leadership

Succession

Drawing on lessons from Robert Dell of Latham and

Vincent Cino of Jackson Lewis, I had the privilege to co-author this column in

Forbes discussing best practices for leadership succession in law firms. Drawing on lessons from Robert Dell of Latham and

Vincent Cino of Jackson Lewis, I had the privilege to co-author this column in

Forbes discussing best practices for leadership succession in law firms.

In it we identified the six steps to take if you are

the retiring firm leader and the five actions appropriate to the incoming firm

leader.

Post #699 – Tuesday, April 1, 2014

To Be A Better Version Of Yourself

I spotted a great

article authored by Marshall

Goldsmith. Marshall and I

both had contributions included in a book published a few years back, entitled In The Company of Leaders. In this piece, Marshall was talking about how

difficult it can be sometimes when you are trying to coach someone who is

resistant. I spotted a great

article authored by Marshall

Goldsmith. Marshall and I

both had contributions included in a book published a few years back, entitled In The Company of Leaders. In this piece, Marshall was talking about how

difficult it can be sometimes when you are trying to coach someone who is

resistant.

A very wise leader

once told me that being coached is about being open to all possibilities. It is about being challenged “to be a better version of yourself.” It follows that one might ask, how do you

know when someone is coachable or not? The harsh truth is

that maybe this particular lawyer is coachable, but just not coachable by

you! That is to say, it’s not the coaching

we resist. We are simply very discerning

about who we will welcome into

something as profoundly personal as coaching. When someone is attempting to

coach us we are usually thinking: Does this person

truly care about me, my career, my challenges or are they going through the

motions simply because . . . it is part of their job description? Can I trust this

individual to be candid with me but also empathetic to the situation or

circustances that I am dealing with?

Can this indicidual

serve as a good, objective sounding board and does this individual have some

valuable guidance to offer me?

Read my entire

article as posted on LinkedIn

Post #698 – Tuesday,

April 1, 2014

Scenarios For Economic Destruction

My economist buddy

sent me an e-mail yesterday posing an interesting economic scenario . . . as a

retaliation for US sanctions on Russia in the wake of the invasion of Ukraine,

Russia responds like this: Hackers attack the New York Stock Exchange and force

it to close indefinitely; the Russian government dumps its billions of US

Treasuries in the open market, causing interest rates to rise and crashing the

US real estate market. The banks go into turmoil as people panic and withdraw

their money. It would be a Russian

strike on the US, without firing a shot.

That was a scenario hedge fund manager, economist and author

Jim Rickards painted on the new era of financial warfare in a speech he

delivered to a gathering of economists yesterday. And if you think the Russian scenario is

far-fetched, Rickards pointed out that the US effectively did something similar

for real in Iran. It was only a few

years ago that the US government shut Iran out of the US dollar payments

system. This was in response to Iran's

nuclear program.

The thrust of Rickards speech was whether the US dollar will

survive in its role as the reserve currency of the world and hold the current

system in place. It doesn't take too

much guesswork from the subtitle of his new book The Death of Money: The

Coming Collapse of the International Monetary System to see where he stands

on that front. Rickards made the point

that a major pillar of support for the US dollar is on wonky foundations: the

Saudi-US alliance. The deal's been

simple for over forty years. The Saudis

sell oil in US dollars only. The US

provides protection and security to the House of Saud. This deal was brokered between Henry Kissinger

and the Saudi royalty in the 1970's. But Rickards argues that

the Obama administration has moved to appoint Iran as the regional hegemon, and

this is regarded as a stab in the back by the Saudis, who may now move to align

with Russia and China.

Also, as best selling author of Currency Wars, Rickards is

now speaking bluntly about what he has labelled as the coming World War D. The D actually stands for two things.

The first is Devaluation.

The first cannon in

this war fired on September 27, 2010. On

that day Brazilian Finance Minister Guido Mantega became the first world leader

to use the words ‘currency war’. What did he

mean? Simply that countries are now using

a variety of means to devalue their currencies. They’re not doing it just for fun. They’re doing it to try and make their exports

more attractive and to bolster their ailing economies. Think of it as something akin to a retail war.

One shopping chain tries to

‘out-discount’ another. And it’s a race

to the bottom.

It’s called currency

devaluation. And everyone’s doing it —

Argentina, Brazil, Venezuela, South Africa, Turkey, Ukraine, Canada, China. And, of course, America. I know this is not a

breaking headline. ‘Currency War’ has

been in the news-cycle for several years now. What HASN’T been talked about is where

national governments are taking us with this tactic.

The second D stands for Global

Debt and to get what that means, you have a have a look at this

extraordinary chart:

The blue line on the

chart shows the total size of the global debt securities market (basically

global government debt). It has now hit

ONE HUNDRED TRILLION DOLLARS, according to the Swiss-based Bank for

International Settlements (BIS). That mammoth debt

pile is now 140% the size of global economy. In 2007 it was 70%. It’s doubled. Now let’s just admit the obvious right now:

it’s impossible to grow out of that kind of debt. Not gonna happen! Nor will governments

solve this problem by ignoring it, which is what they’re doing now.

I am posting this on April 1st, but must assure you that

this is no April Fools joke. This all

could proffer serious consequences – most of which I don’t even fathom. But I will be following this carefully.

Post #697 – Tuesday, March 18, 2014

Assessing Your Worth As A Practice Leader

When we look in the

mirror we tend to have an overinflated view of what would be considered our

positive qualities and an underinflated view of our negative ones. There are a multitude of academic studies that

prove this. Researchers call it

“illusory superiority” and it’s a bias that shows up in a wide range of

personality, cognitive, performance, and other self-assessments. When we look in the

mirror we tend to have an overinflated view of what would be considered our

positive qualities and an underinflated view of our negative ones. There are a multitude of academic studies that

prove this. Researchers call it

“illusory superiority” and it’s a bias that shows up in a wide range of

personality, cognitive, performance, and other self-assessments.

Recently I was

sharing some data with a group of practice group leaders on the impact of

asking for feedback. The data shows a

strong correlation between asking for feedback and the overall effectiveness of

any leader. During our dicussion one of

the practice leaders asked if I might suggest four or five questions he could

ask his fellow partners to get a sense of how they were viewing his

efforts.

Here are the sample questions

I recommended this leader pose:

• What do you see as my strengths and what value am I

currently adding to our practice group?

• What skills, behaviors or attributes do you think I need

to work on improving?

• What do you need from me that you are not currently

receiving in the way of coaching or assistance?

• Is there anything more that I could be doing to have you

feel that I have your best interest at heart?

• Do you feel comfortable bringing your professional and

personal problems to me? If not, why?

• What concerns or questions do you have for me that you’ve

been reluctant to mention?

The process of

asking others for feedback puts us in a position to listen carefully to the

feedback, ask questions, clarify the feedback, and then accept the feedback.

When was the last

time you formally asked your partners what value you were adding to your group?

Post #696 – Saturday, March

1, 2014

The Toxicity Of A Bad

Lateral Hire

A

heard this story the other day from the former office managing partner of an

AmLaw 50 firm and it probably sums up one of the primary causes of law firm

dissolutions over the past few years.

“A large law firm of

unsurpassed quality is not unlike a barrel of fine wine, where every partner is

a teaspoon of the prized libation. Every

teaspoon full makes a contribution and lends its qualities, and weaknesses, to

the whole. Let's do an experiment with wine and lawyers.

You stand beside two

barrels. One is filled with fine wine, the other is filled with sewage.

You then take a teaspoon

of the fine wine, and deposit it into the barrel of sewage. There is no

change. You still have one barrel of

fine wine, and one barrel of sewage.

However, reverse the

process. Now deposit a teaspoon of

sewage into the barrel of fine wine. There is a huge difference; you now

have two barrels of sewage.

Is it not so with law

firms?

Especially if you think

bringing on lawyers because of their prospects for bringing a lucrative book of

business with them is your highest priority, or that expanding internationally is

always a good idea because law firms have the leadership skills to handle what

all their partners are up to.”

I’m delighted to be

participating in a Webcast on the subject of lateral hiring. It is scheduled for March 12 at 12:00 noon

(Pacific) and hosted by LA Daily Journal (www.dailyjournal.com)

– California’s largest legal newspaprer.

I’ll be joined by Professor Bill Henderson (Indiana University Maurer

School of Law); Michael Roster (former managing partner of Morrison &

Foerster’s Los Angeles office); and Edwin Reeser (served on the executive

committees and as an office managing partner of firms ranging from 25 to over

800 lawyers in size).

Thursday, March 13, 2014You can view our Webcast on the topic of lateral hiring and hosted by the LA Daily Journal - http://lnkd.in/bc9sU58 Successful Lateral Hiring

spreecast.comNew partners can be a sound addition to a law firm's practice base and revenues. However, there are challenges to integrating them successfully. The panel explores how to create success stories instead of disappointments and disasters.

Post #695 – Friday, February 14, 2014

Listening To The Client’s Voice

At our Compensation ThinkTank in New York we had the

privilege of welcoming two in-house counsel guests: Tom Trujillo, Director of

Operations for the Bank of America Legal Department and Steven Greenspan,

Associate GC at United Technologies Corporation. Tom instructs an outside counsel group of

about 1750 law firms while Steven deals with over 600. Their topic was “Client Priorities” and here

are a couple of highlights from our discussions: At our Compensation ThinkTank in New York we had the

privilege of welcoming two in-house counsel guests: Tom Trujillo, Director of

Operations for the Bank of America Legal Department and Steven Greenspan,

Associate GC at United Technologies Corporation. Tom instructs an outside counsel group of

about 1750 law firms while Steven deals with over 600. Their topic was “Client Priorities” and here

are a couple of highlights from our discussions:

• Firms need to appreciate that supply side concepts like

“process maps”, “staffing plans” and “lean project management” must be part of

your conversation when working with in-house legal departments. Clients are looking to see how firms will

utilize process improvements to enhance quality and reduce costs, while still

maintaining and perhaps enhancing their own profitability.

• During one discussion both Tom and Steven were asked, “How

many of the law firms that you deal with, proactively seek a formal meeting

with you to elicit your feedback on performance and satisfaction?” Tom responded

“2 firms” while Steven thought it might be maybe 4 to 6. (Yes,

please do go back and look at just how many outside law firms these two

gentlemen deal with!) They

proceeded to explain that many more of their outside law firms would claim that

they seek feedback simply because they might ask a question (“Ahh, so how are

we doing?”) in passing. But that is NOT

what these clients are looking to have their external advisors do. Taking it a step further, both of them spoke

to wanting to be interviewed by senior lawyers from their firms who are NOT

involved with the work, so that they can offer more candid feedback.

• Our in-house guests warned the audience that it was

starting to become more common for firms to have to deal with Procurement

Departments that unashamedly ask law firms to disclose their margins on the

work that they are doing for the client – and obviously want to share in those

margins. One of the problems firms have

in answering that question, is in how firms interrupt margin since they don’t

include the cost of the partner in any calculation. It is a bit like a corporation not including

the costs of the president and senior executives of the company and then

claiming that they operate with a 25% margin rather than the 5% that is reported

according to accepted accounting standards.

• One question from the audience caught our panelists

off-guard and that was whether either or both of their corporations were

shifting legal work, specifically over $5 million/annually, to “disruptors” (like

Axiom, outsourcing companies, and other non-traditional service providers)? Both Tom and Steven answered to the

affirmative and responded that the legal work going to these providers was

“growing materially.”

• Finally, Tom and Steven shared three law firm metrics that

undermine inside-outside relationships: high turnover, high profit-per-partner

and productivity hours-based bonuses – all because they put the firm’s interest

ahead of the clients. They also explained that that they believed that certain firm

compensation systems undermine professionals in properly serving their clients

– “eat-what-you-kill,” highly formula based, and systems that largely look at

billable hours as the primary determinant of rewards. There was some further discussion as to

whether having open compensation systems was for the best when one of my fellow

speakers, a notable consultant to the accounting profession informed us all

that 90% of the Top 100 Accounting Firms have all moved to closed systems.

Post #694 – February 3, 2014

The Compensation Impasse

At our Compensation ThinkTank last week in New York with

some 50 firm leaders, one of my fellow speakers spoke eloquently and presented

insightful statistics on the degree of excess capacity, stagnant demand and

suicidal pricing pressures that firms are currently facing. At the conclusion of his talk he offered “a

five-step program for your partners.” At our Compensation ThinkTank last week in New York with

some 50 firm leaders, one of my fellow speakers spoke eloquently and presented

insightful statistics on the degree of excess capacity, stagnant demand and

suicidal pricing pressures that firms are currently facing. At the conclusion of his talk he offered “a

five-step program for your partners.”

His five steps consisted of:

• Denial: Snap out of it; understand the world has

changed. We’re not all going back to

2006.

• Anger: Is fruitless.

Your clients have done nothing wrong.

• Bargaining: With the managing partner, the compensation

committee, and your friendly local headhunter will get you nowhere;

• Depression: Let us

know when you feel like behaving as an adult again; and

• Acceptance: You’ve had an insanely great 25-year run, how

about a little gratitude?

When the request for questions arose, I could not contain

myself from offering an observation:

These five steps all assume one thing – that when dealing with your

partners on money issues, you are dealing with RATIONAL people! I would respectfully submit that that may NOT

be the case.

Exhibit One. At a

time when many firms have come off a year of flat revenues (at best) and fairly

flat profitability, one of the common stories that I’m hearing from managing

partners is about having to confront the partner with the big book of business

who wants more money this year. When

informed that the firm’s revenues and profits are flat and indeed that even

this partner’s billings and performance was on only par with last year, the

response the firm leader gets is that the partner still feels they deserve

more. When asked why they feel that way

given the statistics, the demanding partner informs you that their book of

business is obviously worth even more

to the firm now than it was last year.

Exhibit Two.

Conventional wisdom, as well as economic theory, tells us that the more

of something we have, the less of it we want . . . but that is not the case

with money! According to some brand new

research released in January by Jeffrey Pfeffer (professor of organizational

behavior at Stanford’s Business School), money earned through our individual

labors is more important to us than money that comes from other sources like

investments. And the more money paid for

each hour of work, the more important that money becomes. According to Jeffrey’s research paper, “When Does Money Make Money More Important”

money is like an addictive substance in that it raises the bar and leaves

people always wanting more. We generally

believe that our compensation communicates our self-worth. The higher the compensation, the more importance the person places on

money.

Now I don’t know what the answer is and we certainly did not

get any magic bullets from either the five step suggestion above or from any of

the other discussions during the day, but it would seem that leaders who focus

on money as THE reward are going to have to give more and more of it to have

any motivational effect.

What do you think?

Rant #693 – January 22, 2014

How Important Is Leadership In Law Firms?

I recently received a

research report from the folks at Service Performance Insight (SPI),

a global research and training organization, entitled “Just How Important is Leadership in the Success of Professional

Service Firms?” For the past seven

years SPI has been analyzing leadership metrics, across a number of

professions, in their annual benchmarking initiatives. They ask a number of questions, which are

subjective in nature, yet provide insight into the importance of something as

difficult to measure as leadership. I recently received a

research report from the folks at Service Performance Insight (SPI),

a global research and training organization, entitled “Just How Important is Leadership in the Success of Professional

Service Firms?” For the past seven

years SPI has been analyzing leadership metrics, across a number of

professions, in their annual benchmarking initiatives. They ask a number of questions, which are

subjective in nature, yet provide insight into the importance of something as

difficult to measure as leadership.

The questions include the degree to which:

• the firm’s strategic direction is clearly communicated and

well understood;

• partners have confidence in the firm’s leadership;

• it is relatively easy to

get things done within the firm;

• leadership communicates

effectively;

• leadership embraces change

and is nimble and flexible’

• leadership focuses on

innovation and is able to take advantage of changing market conditions; and

• everyone has confidence in

the future of the firm.

The clear result of their

seven years of research is that firms with strong leadership – those scoring

highest in answering their questions (on a 1 to 5 scale) evidence far stronger

results in areas like: higher revenue growth, client service efficiency, and

percentage of new business derived from new clients, among other key

performance indicators. In other words,

firms with leaders who truly lead their firms, with higher levels of

communication and collaboration, grow their organizations at a much higher rate

than those lacking these qualities.

Now this research, to the

best of my knowledge, measures leadership in consulting, engineering and other

professional service firms, but does not include any law firms. In law firms, we seem to have a different

mind-set towards how important leadership really is. That mindset was on display this past week

within two published news articles.

First there was the

Citibank/HBR 2014 Client Advisory, which provided a commentary under the title:

The Leadership Challenge. According to this report, “One

development which gives us concern is that some of the newer breed of leaders

continue to maintain busy, full time practices. In this scenario, their clients’ needs are

likely to take priority, to the detriment of the management of the firm. If we could see any change, it would be that

firms recognize that to be effective, the firm leader is best performed as a

full time role.” My own surveys have

shown that there is a significant reduction in the number of full-time firm

leaders since 2004, with many of the new incumbents looking to maintain a minor

practice (minimum of 500 to 1200 hours) that they can go back to when their

term expires.

At the extreme other end of

the spectrum is an AmLaw Daily report, last week, on the defection of a couple

of practice group leaders at Dorsey & Whitney. In any law firm your practice groups

constitute the fundamental underpinnings of your organization. I have long joked with managing partners that

what you are managing is not one homogenous organization, but rather a

portfolio of very different businesses.

So, when any of your business unit leaders depart, especially if they

are going to a competitive firm, it is a pretty significant event.

Asked

about the losses, Dorsey managing partner downplayed their impact by saying,

“We have more than 60 practice groups here, so we give out a lot of titles.” Asked

about the losses, Dorsey managing partner downplayed their impact by saying,

“We have more than 60 practice groups here, so we give out a lot of titles.”

Doing

a bit of research I find that there are 248 partners at Dorsey, but not sure

how many of those are equity partners.

Looking to my latest 2014 issue of the Yellow Book I see entries of 40

practice groups - so maybe only two-thirds of all of their groups. But 26 of those groups (65%) have co-chairs

(and one with three co-chairs) therefore providing for a further listing of 67

practice group leaders. Projecting these

numbers out, one can assume that with “more than 60 practice groups” over 100

of the 248 partners at Dorsey are in practice leadership positions. But wait, that’s not all! Then there is the firm management committee,

an elected board, and we must not forget the 13 office managing partners. It looks like the majority of partners at

Dorsey are all in some kind of leadership position . . . which leaves us only to wonder

who there is left that is being led.

How important is leadership

in law firms? I’ll let you decide.

Page << Prev 20 21 22 23 24 25 26 27 28 29 Next >> of 95

|

Ashridge House

Ashridge House  11226 - 60 Street

11226 - 60 Street  Edmonton, Canada

Edmonton, Canada  T5W 3Y8

T5W 3Y8